USDN: The Yield-Generating Stablecoin Revolutionizing DeFi

Stablecoins have become an essential part of the cryptocurrency ecosystem, bridging the gap between traditional finance and decentralized finance (DeFi). Most of the popular options, such as USDT and USDC, primarily benefit their issuers while providing no direct earnings for users. However, a novel financial model USDN has emerged, offering holders a share of the returns generated through U.S. Treasury bond investments.

Unlike conventional stable digital assets, this innovative approach aligns the interests of various stakeholders, including developers, validators, and platforms supporting the ecosystem. With an approximate annual yield of 4.15%, it offers a compelling alternative for those seeking passive income opportunities in crypto.

Table of Contents

How USDN Works

Yield Generation Through Treasury Bonds

Rather than operating as a simple digital equivalent of cash, USDN generates profits through carefully structured investments:

- Backing by U.S. Treasury Bonds

- Funds held in reserves are invested in Treasury bonds, one of the most secure financial instruments.

- These assets generate interest, currently around 4.15% annually.

- Profit Distribution Mechanism

- Instead of concentrating earnings within a single entity, returns are shared among users, validators, and developers.

- This creates a more balanced financial model compared to traditional stable digital assets.

- Dynamic Yield Adjustments

- The payout percentage fluctuates based on Treasury bond performance.

- If bond yields rise or fall, the distributed returns adjust accordingly.

USDN introduces a fresh perspective on how stable assets can operate within the DeFi ecosystem.

Comparing Yield-Generating Stablecoins to Traditional Options

| Feature | USDN | USDT | USDC |

|---|---|---|---|

| Yield for Holders | ✅ Yes (4.15% annual) | ❌ No | ❌ No |

| Backing Assets | U.S. Treasury Bonds | Mixed Reserves | Cash & Short-Term Bonds |

| Transparency | ✅ High | ❌ Limited | ✅ High |

| Decentralization | ✅ Yes | ❌ No | ❌ No |

While USDT and USDC are widely used, their earnings primarily benefit the issuing companies. USDN introduces a fairer approach, rewarding those who hold the asset rather than just the issuers.

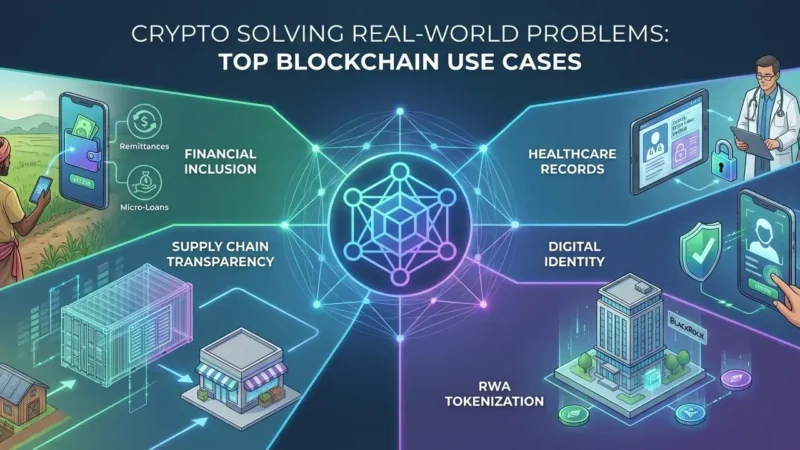

Why USDN is a Game-Changer for DeFi

DeFi thrives on decentralization, financial inclusion, and innovation. This yield-bearing USDN contributes to these goals in multiple ways:

- Sustainable Passive Income – Unlike traditional stablecoins, which serve primarily as transaction tools, this digital asset provides regular returns.

- Balanced Incentive Structure – Users, developers, and validators all receive a share of the earnings, fostering long-term adoption.

- Enhanced Stability – By relying on U.S. Treasury bonds, it maintains a robust reserve system.

These advantages make it a strong contender in the evolving digital asset landscape.

Potential Risks and Considerations

Despite its advantages, this financial instrument is not without challenges:

1. Regulatory Uncertainty

- Governments are closely monitoring stablecoin developments.

- Future regulations may impact its ability to generate and distribute yields.

2. Adoption Challenges

- Competing against well-established stable assets like USDT and USDC requires strong partnerships and user trust.

3. Interest Rate Fluctuations

- If U.S. Treasury bond rates decrease, the payout to holders will also decline.

While these risks exist, the overall benefits present a compelling case for its adoption in DeFi.

The Future of Yield-Generating Stablecoins

This innovative model marks a shift toward more user-centric financial solutions. As more investors seek yield-bearing alternatives, stable assets with built-in passive income potential could see wider adoption.

Possible Future Developments

- Expanded integration across DeFi platforms – More lending, staking, and trading platforms may incorporate this yield-based asset.

- Regulatory clarity – Clearer guidelines could encourage broader adoption.

- New competitive stablecoins – Similar financial instruments may emerge, offering different levels of returns and mechanisms.

Its long-term success will depend on navigating regulatory challenges, growing market adoption, and maintaining a sustainable yield structure.

Frequently Asked Questions

1. How does this USDN differ from USDT and USDC?

Unlike USDT and USDC, which do not share profits with holders, USDN distributes earnings generated from Treasury bond investments.

2. How is the yield generated?

Returns come from U.S. Treasury bond investments, with profits distributed among users, validators, and developers.

3. Is this a secure financial product?

It is backed by highly stable assets (Treasury bonds), but users should consider regulatory and market risks.

4. Will the 4.15% yield remain constant?

No, the return rate will fluctuate depending on Treasury bond performance.

5. How can I benefit financially from holding this asset?

Simply holding it allows users to receive a share of the generated yield, similar to earning interest on savings.

6. Is this digital currency decentralized?

Built on the Cosmos blockchain, USDN follows a more decentralized structure compared to centralized stablecoins like USDT.

Stay informed, read the latest crypto news in real time!

Conclusion

The introduction of a yield-generating stable asset marks a significant evolution in the DeFi space. By distributing earnings from Treasury bond investments to holders, developers, and validators, USDN represents a departure from traditional stablecoin structures.

With an annual return of around 4.15%, USDN offers crypto investors a way to earn passive income while maintaining price stability. However, its long-term success will depend on regulatory developments, adoption rates, and competition from existing market leaders.

As decentralized finance continues to expand, stable assets that reward users could play a major role in shaping the future of digital financial systems.