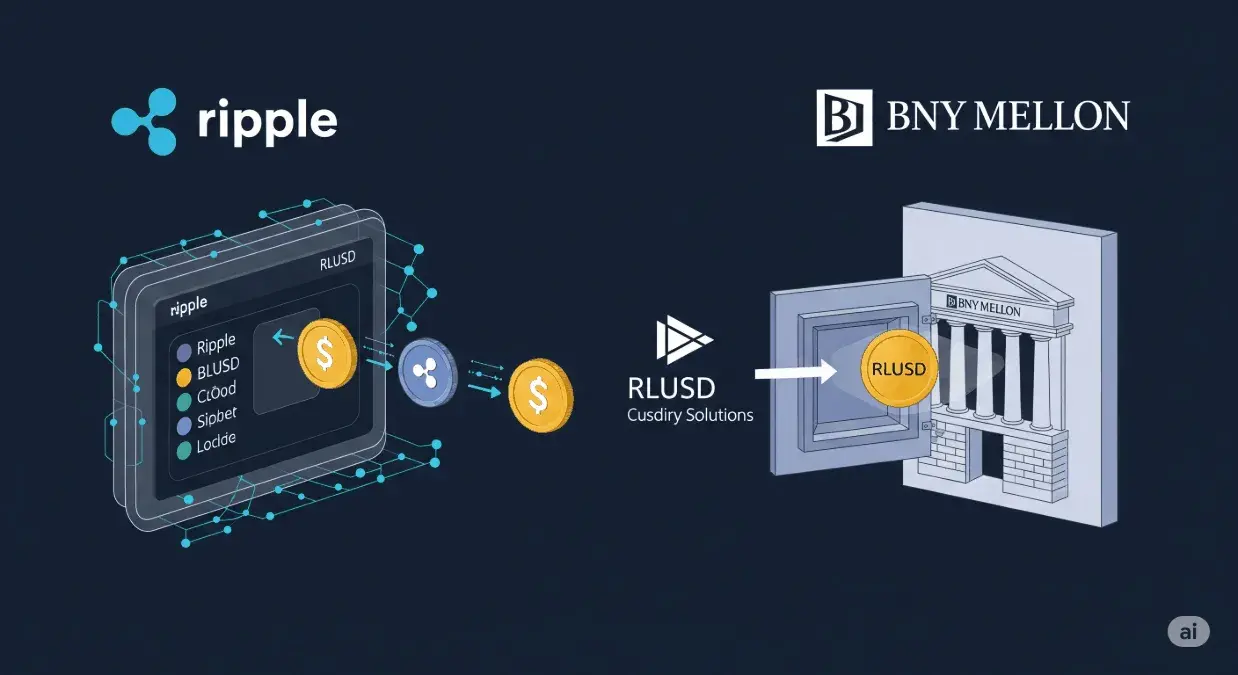

Ripple’s RLUSD Reaches New Heights with BNY Mellon Partnership

Ripple, a leader in enterprise blockchain and crypto solutions, has announced a significant milestone for its dollar-backed stablecoin, RLUSD. The company has officially appointed BNY Mellon, one of the world’s largest financial institutions, as the custodian for the cash and Treasury reserves that back RLUSD. This strategic partnership underscores Ripple’s commitment to strengthening the operational infrastructure of its stablecoin, which has already surpassed an impressive $500 million in circulation just seven months after its launch.

The collaboration with BNY Mellon is a pivotal move for RLUSD, adding a traditional banking partner with extensive experience in digital assets. As dollar-backed stablecoins gain increasing traction among financial institutions and large corporations, such partnerships are becoming essential for building trust and ensuring stability in the burgeoning digital asset market.

BNY Mellon: A Custodian for Digital Assets

BNY Mellon, boasting an staggering $52 trillion in assets under custody, will play a crucial role in safeguarding and managing the liquidity of the reserves guaranteeing RLUSD’s 1-to-1 convertibility with U.S. dollars. This partnership leverages BNY Mellon’s deep expertise in traditional finance, merged with its established presence in the digital asset space. The bank initiated its services to institutional crypto clients in 2022, following the establishment of a dedicated digital assets unit in the preceding year. Its operational standards mirror those governing traditional money market funds, providing a robust and familiar framework for RLUSD’s underlying assets.

Beyond safeguarding reserves, BNY Mellon will also deliver comprehensive transaction banking services, supporting Ripple’s daily operations. This integration of traditional banking infrastructure with enterprise-grade crypto solutions signifies a growing trend towards mainstream adoption of digital assets. Regulated stablecoins, offering immediate liquidity and secure custody, are rapidly emerging as indispensable tools for international payments and efficient corporate liquidity management.

RLUSD: Designed for Enterprise Financial Operations

Launched in December 2024 on both the XRP Ledger and Ethereum, RLUSD was specifically designed to cater to enterprise financial operations. Unlike many stablecoins primarily geared towards retail users, RLUSD is licensed by the New York Department of Financial Services (NYDFS). This regulatory oversight distinguishes it within the stablecoin ecosystem, providing an added layer of credibility and security for institutional adoption.

The framework supporting RLUSD is built on several key pillars:

- Backing with High-Quality Liquid Assets: Ensuring stability and reliability.

- Third-Party Audits: Providing transparency and accountability to holders.

- Clear Redemption Rights: Guaranteeing that holders can convert their tokens to U.S. dollars seamlessly.

Pursuing a National Trust Bank Charter

In a move set to further solidify its position in the institutional market, Ripple has formally applied for a national trust bank charter with the Office of the Comptroller of the Currency (OCC). This federal banking license, if granted, would authorize Ripple to issue RLUSD under national banking regulations and directly manage customer deposits. This strategic pursuit reflects Ripple’s long-term vision to embed RLUSD deeper into the regulated financial system, a timely decision as major multinational corporations like Amazon and Walmart, alongside leading banks, are actively exploring and entering the stablecoin business.

Stay informed, read the latest crypto news in real time!

The combination of a robust custodial partnership with BNY Mellon and the pursuit of a federal banking license positions RLUSD at the forefront of the evolving digital finance landscape. It aims to offer a regulated, transparent, and highly liquid stablecoin solution for enterprise-grade applications, facilitating more efficient and secure cross-border payments and corporate treasury management. The continued growth and strategic partnerships surrounding RLUSD signal a maturing market for stablecoins, moving beyond niche cryptocurrency applications to become a foundational element of the global financial infrastructure.