Gold-Backed Stablecoins: Bridging Crypto and Precious Metals

The cryptocurrency landscape, known for its volatility, is constantly evolving. Amidst the fluctuating values of digital assets, a unique concept has emerged: Gold-backed stablecoins. These innovative financial instruments aim to combine the stability of gold with the efficiency and accessibility of blockchain technology.

Understanding Stablecoins

Before dissecting Gold-backed stablecoins, it’s crucial to understand the concept of stablecoins in general. Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to a stable asset, such as fiat currencies (like the US dollar) or commodities. This pegging mechanism aims to provide a more predictable and reliable store of value compared to traditional cryptocurrencies like Bitcoin or Ethereum.

The Appeal of Gold

Gold has historically been regarded as a safe-haven asset, maintaining its value over long periods and acting as a hedge against inflation and economic uncertainty. Its inherent scarcity and universal recognition contribute to its perceived stability. Integrating gold into the digital asset space through Gold-backed stablecoins seeks to leverage these qualities.

How Gold-Backed Stablecoins Work

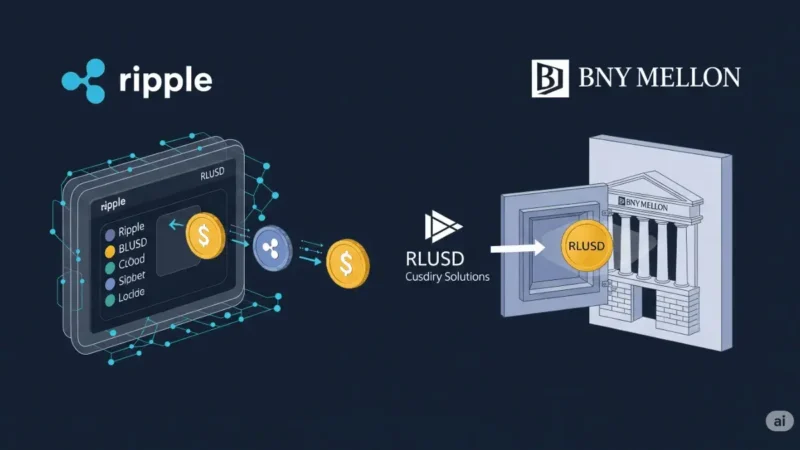

Gold-backed stablecoins typically operate by issuing digital tokens that represent ownership of physical gold reserves held by a custodian. Each token is pegged to a specific amount of gold, ensuring that its value remains relatively stable. The gold reserves are usually stored in secure vaults, and the issuer provides transparency by regularly auditing and verifying the holdings.

The process generally involves:

- Gold Acquisition: The issuer acquires physical gold bars or coins and stores them in secure vaults.

- Token Issuance: Digital tokens representing ownership of the gold are issued on a blockchain.

- Pegging Mechanism: Each token is pegged to a specific amount of gold, ensuring that its value tracks the price of gold.

- Redemption: Token holders can typically redeem their tokens for the equivalent amount of physical gold or its cash equivalent.

- Transparency and Audits: Regular audits and verifications of the gold reserves are conducted to maintain transparency and trust.

Benefits of Gold-Backed Stablecoins

- Stability: The primary benefit of Gold-backed stablecoins is their price stability, which makes them attractive to investors seeking to mitigate the volatility of traditional cryptocurrencies.

- Hedge Against Inflation: Gold’s historical role as an inflation hedge is transferred to these digital assets, offering a potential safeguard against economic downturns.

- Accessibility: Gold-backed stablecoins provide access to gold ownership to a broader audience, including those who may find it challenging to purchase and store physical gold.

- Liquidity: These stablecoins offer improved liquidity compared to physical gold, as they can be easily traded on cryptocurrency exchanges.

- Transparency: Reputable issuers provide transparent audits and verifications of their gold reserves, enhancing trust and confidence.

- Diversification: Investors can diversify their cryptocurrency portfolios by including Gold-backed stablecoins, reducing their overall risk exposure.

Challenges and Considerations

Despite their potential benefits, Gold-backed stablecoins also face several challenges:

- Custodial Risks: The security and integrity of the gold reserves depend on the custodian’s reliability.

- Counterparty Risk: The issuer’s financial stability and operational efficiency are crucial for maintaining the peg and ensuring redemption.

- Regulatory Uncertainty: The regulatory landscape for stablecoins is still evolving, and varying jurisdictions may impose different requirements.

- Transparency and Audits: Ensuring consistent and reliable audits is essential for maintaining trust.

- Storage and Security: Physical gold storage presents logistical challenges and security concerns.

- Fees and Costs: Transaction and redemption fees can impact the overall cost-effectiveness.

The Future of Gold-Backed Stablecoins

The future of Gold-backed stablecoins appears promising, driven by the increasing demand for stable and reliable digital assets. As blockchain technology matures and regulatory frameworks become clearer, these stablecoins are expected to gain wider adoption.

Potential developments include:

- Increased institutional adoption as financial institutions seek to integrate stablecoins into their portfolios.

- Enhanced transparency and security through advancements in blockchain technology.

- Integration with decentralized finance (DeFi) platforms, expanding their utility.

- Standardization of regulatory requirements across different jurisdictions.

- Further innovation in the way that these coins are secured and traded.

The Role in the Broader Crypto Ecosystem

Gold-backed stablecoins play a vital role in the broader cryptocurrency ecosystem by providing a bridge between traditional assets and digital currencies. They offer a stable alternative to volatile cryptocurrencies, attracting investors who seek a more conservative approach to digital asset investment. In times of market turmoil, these stablecoins can act as a safe haven, allowing investors to preserve their capital.

Stay informed, read the latest crypto news in real time!

Conclusion

Gold-backed stablecoins represent a significant step towards bridging the gap between traditional finance and the evolving cryptocurrency landscape. By combining the stability of gold with the efficiency of blockchain technology, these stablecoins offer a unique value proposition for investors seeking a secure and reliable digital asset. While challenges remain, the potential benefits and growing adoption suggest that Gold-backed stablecoins will play an increasingly important role in the future of finance. The combination of digital convenience and the long term value of gold is a powerful incentive for many investors. As the crypto world continues to mature, we can expect to see further innovation and growth in this sector. More businesses are seeing the value in these coins, and as such, the market is growing.