Revolutionizing Finance: The Impact of Blockchain on Financial Derivatives

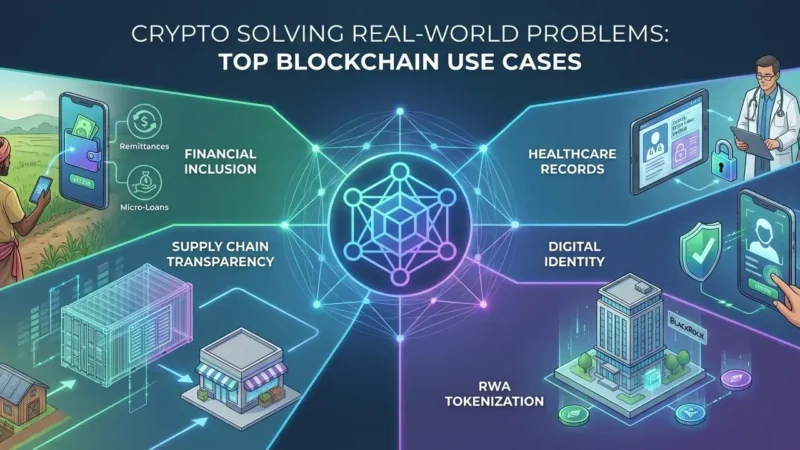

Introduction to Blockchain Technology

Blockchain technology represents a groundbreaking innovation in the financial sector, redefining how transactions are conducted, recorded, and verified. At its core, blockchain is a distributed ledger technology (DLT) that operates on a decentralized network of computers, known as nodes. This decentralization eliminates the need for a central authority, allowing users to transact directly with one another, thereby enhancing efficiency and reducing costs associated with intermediaries.

Table of Contents

One of the most critical components of blockchain technology is its immutability. Once information is recorded on the blockchain, it becomes nearly impossible to alter or delete it. This feature provides a high level of security and trust, as all participants in the network can verify the authenticity of transactions without relying on a central repository. Immutability ensures that each financial derivative recorded on the blockchain is permanent and transparent, which can significantly impact how these instruments are traded and settled.

Transparency is another cornerstone of blockchain technology. Every participant in the blockchain network has access to the same version of the ledger, which fosters an environment of accountability. This level of transparency is especially advantageous in financial derivatives, where the complexities of trade often lead to information asymmetry. With blockchain, stakeholders can easily trace the history of a derivative from its creation to its current holder, effectively mitigating the risks associated with fraud and discrepancies.

This transformative technology has garnered extensive interest across various sectors, particularly in finance, due to its potential to enhance operational efficiency, reduce costs, and improve security. As financial institutions explore the integration of blockchain into their operations, the implications for traditional financial derivatives and their market dynamics could be profound, setting the stage for a new era of financial trading.

What Are Financial Derivatives?

Financial derivatives are complex financial instruments that derive their value from an underlying asset, index, or interest rate. They are primarily used for hedging purposes, speculation, or arbitrage, playing a crucial role in modern financial markets. By understanding the structures and types of financial derivatives, investors can effectively manage risk and capitalize on market opportunities.

There are several types of financial derivatives, with the most common being options, futures, swaps, and forwards. Options provide the holder with the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified expiration date. This flexibility allows investors to maintain leverage and manage their exposure to asset price fluctuations. Conversely, futures contracts obligate the buyer to purchase, and the seller to sell, an asset at a specified future date and price. Futures are standardized and traded on exchanges, which enhances liquidity and facilitates price discovery in financial markets.

Swaps involve the exchange of cash flows between two parties based on different financial instruments, commonly interest rates or currencies. They enable participants to transform their cash flow exposure, allowing for interest rate risk management, among other advantages. Forwards, on the other hand, are customized contracts between two parties to buy or sell an asset at a future date for a price agreed upon today. While similar to futures, forwards are typically traded over-the-counter, allowing for greater flexibility in terms of contract specifications.

The significance of financial derivatives lies in their ability to hedge against adverse price movements, speculate on future price changes, and benefit from arbitrage opportunities. For instance, an investor anticipating a decline in a stock’s price may purchase a put option, thereby securing a potential profit when the stock inevitably falls. Through these methods, financial derivatives have become indispensable tools for market participants seeking to navigate the complexities of financial risk management.

The Traditional Derivative Market: Challenges and Limitations

The conventional financial derivatives market has faced numerous challenges and limitations over the years that can hinder market efficiency and participation. One of the significant issues is the lack of transparency, which affects the pricing of derivative instruments. Without clear visibility into market activities, traders and investors struggle to obtain accurate information needed to make informed decisions. This opacity can lead to mispricing and a potential misallocation of resources within the market.

Another critical challenge is counterparty risk. In traditional derivatives trading, each party is exposed to the possibility that the other will default on their contractual obligations. The absence of a central clearinghouse in some markets increases this risk, making it difficult to assess the creditworthiness of trading partners. This uncertainty can deter participation from both institutional and retail investors, ultimately leading to reduced liquidity in the market.

Furthermore, high transaction costs represent a barrier to entry for many participants. Fees associated with trading financial derivatives can accumulate quickly, especially for those executing frequent transactions. Such costs not only cut into potential profits but may also discourage smaller investors from engaging actively in the market. As a result, this can create an uneven playing field where only larger investors thrive, exacerbating inequality within the market.

Additionally, inefficiencies in settlement processes pose yet another challenge. Traditional derivatives often involve complex, multilayered transactions that can result in delays and errors during the post-trade settlement phase. These inefficiencies can lead to increased operational risks and make it difficult for market participants to manage their portfolios effectively. The cumulative impact of these challenges can deter market engagement and ultimately affect the overall stability and growth of the financial derivatives market.

How Blockchain Transforms Financial Derivatives

Blockchain technology is heralding a new era for financial derivatives, offering a range of transformative features that can fundamentally reshape this market. Traditional derivatives trading is often mired in complexity due to reliance on intermediaries, cumbersome settlement processes, and limited transparency. However, through the integration of blockchain, these challenges can be effectively addressed.

One of the most significant implications of blockchain in the realm of financial derivatives is the introduction of smart contracts. These self-executing contracts facilitate automatic execution of agreements once predefined conditions are met. This feature not only reduces the risk of counterparty default but also enhances the efficiency of trade settlement, eliminating the need for intermediaries like brokers or clearinghouses. Consequently, market participants can enjoy lower costs and quicker transaction speeds. Furthermore, the transparency of blockchain technology enables all involved parties to view and verify transactions in real-time, enhancing trust across the trading ecosystem.

Real-time settlement is another substantial advantage offered by blockchain. Unlike traditional financial systems where settlements may take several days, blockchain enables instantaneous transactions. This improvement is critical in the derivatives market, where timing can significantly impact both risk management and liquidity. By providing a unified and decentralized ledger, blockchain not only ensures accuracy but also permits users to track the status of contracts in a straightforward manner.

Enhanced security is another key benefit brought about by blockchain technology. The cryptographic nature of blockchain ensures that data integrity is maintained and that unauthorized modifications are practically impossible. This robustness is vital, given the sensitive nature of financial derivatives. With reduced reliance on trust-based models and better security measures, participants can engage in trading activities with increased confidence.

As financial derivatives continue to evolve, the emergence of blockchain serves as a potent agent of change, promoting greater efficiency, security, and transparency in the marketplace.

Case Studies of Blockchain in Derivatives Trading

The integration of blockchain technology into financial derivatives trading has reshaped the landscape of this sector, enhancing efficiency, accessibility, and security. Several notable case studies illustrate how different organizations and exchanges have successfully implemented blockchain solutions to streamline their derivative transactions.

One prominent example is the use of blockchain by the Chicago Mercantile Exchange (CME), which introduced a Bitcoin futures contract in 2017. By leveraging blockchain technology for transaction verification, CME was able to provide a more secure trading environment, minimizing the risk of fraud. The transparency inherent in blockchain systems has also made it easier for regulatory bodies to monitor trading activities, thus enhancing compliance with financial regulations.

Another significant case is the implementation of blockchain technology by the financial technology firm, LedgerX. This organization operates a regulated cryptocurrency derivatives exchange that utilizes blockchain to settle trades in real-time. By ensuring instantaneous transaction finality, LedgerX has drastically reduced counterparty risk associated with derivatives trading, setting a new standard for security and efficiency in the industry.

Additionally, in Europe, the European Stock Exchange has been actively exploring integration with blockchain-based platforms for trading derivatives. The initiative aims to streamline post-trade processes, significantly reducing clearing and settlement times. This development highlights the growing movement within traditional exchanges to adopt innovative technologies for enhancing operational efficiencies.

Furthermore, several decentralized finance (DeFi) platforms are emerging, such as dYdX and Synthetix. These platforms operate on public blockchains and allow users to trade derivatives without the need for centralized authority. By eliminating intermediaries, they not only lower costs but also increase accessibility for retail investors.

These case studies illustrate the transformative potential of blockchain in the financial derivatives market, paving the way for a more efficient, accessible, and secure trading environment.

Regulatory Perspectives on Blockchain and Derivatives

The emergence of blockchain technology has considerably transformed various sectors, particularly finance, where it intersects with financial derivatives. However, this rapid development presents complex challenges for regulatory bodies tasked with overseeing these evolving markets. The decentralized nature of blockchain complicates traditional regulatory frameworks, which were primarily designed for more centralized financial systems. As a result, regulators are grappling with questions surrounding compliance, security, and market integrity.

Regulatory approaches vary across jurisdictions. Some countries, recognizing the potential benefits of blockchain in enhancing transparency and efficiency in financial derivatives trading, advocate for a more innovation-friendly framework. For instance, in jurisdictions like Switzerland and Singapore, regulators have initiated guidelines and sandbox environments to promote blockchain projects while ensuring investor protection and market integrity. These initiatives aim to create a balanced approach that fosters innovation while mitigating potential risks associated with financial derivatives and blockchain.

Conversely, there are regions where regulators adopt a more cautious stance, opting for stricter measures to curb perceived risks. This can manifest in stringent licensing requirements and thorough scrutiny of blockchain-based operations in the financial derivatives landscape. The challenge here lies in creating a regulatory environment that does not stifle innovation while still safeguarding market participants from fraud, manipulation, and systemic risks that might arise from unregulated financial derivative products.

Market participants must stay informed about changing regulatory landscapes, as their operations in the realm of financial derivatives become increasingly interwoven with blockchain technology. Adherence to evolving regulations is crucial for fostering trust and stability in this dynamic market space. Collaboration between regulators and industry stakeholders will be essential in navigating this complex terrain, ensuring that blockchain technology can be harnessed effectively within the derivatives sector.

Future Trends in Blockchain and Financial Derivatives

The integration of blockchain technology in the realm of financial derivatives is expected to usher in transformative changes over the coming years. One of the most significant trends is the rise of decentralized finance (DeFi), which presents new frameworks for trading and managing financial derivatives. DeFi leverages blockchain’s transparency and security, enabling the creation of peer-to-peer trading platforms that eliminate the need for centralized intermediaries. This evolution is likely to result in enhanced accessibility and liquidity for various derivatives products, promoting greater market participation and democratization of financial services.

Moreover, the proliferation of digital currencies will continue to influence the landscape of financial derivatives. With an increasing number of cryptocurrencies being adopted for use in derivatives trading, new instruments are being developed to hedge against the volatility associated with these assets. For example, crypto-based options and futures contracts are gaining traction, offering investors strategies to manage exposure to price fluctuations. This trend is indicative of a broader move towards more innovative and diversified financial products that align with the needs of a digital economy.

In addition to these developments, continuous technological innovations within the blockchain ecosystem are poised to reshape how financial derivatives are structured and executed. Enhanced smart contract functionalities are expected to automate processes related to the settlement and verification of derivative transactions, greatly reducing operational risks and costs. Furthermore, the integration of artificial intelligence and machine learning algorithms in forecasting and risk assessment may lead to more sophisticated decision-making tools for traders and investors alike, thus optimizing the management of financial derivatives portfolios.

Overall, the intersection of blockchain and financial derivatives is set to evolve dramatically, paving the way for a more efficient, transparent, and inclusive financial system.

Potential Risks and Concerns

The integration of blockchain technology into the realm of financial derivatives presents numerous advantages, yet it is imperative to acknowledge the potential risks and concerns that accompany this transformation. A primary concern revolves around cybersecurity risks. As financial derivatives often involve substantial capital and sensitive data, any breaches in security protocols can lead to significant financial losses and the erosion of stakeholder trust. Hackers utilizing sophisticated approaches may target blockchain applications, emphasizing the need for fortified cybersecurity measures to protect both platforms and users.

Market volatility is another considerable concern linked to the implementation of blockchain in financial derivatives. The accessible nature of blockchain technology may lead to an influx of market participants, which, in turn, could contribute to increased volatility. As trading activities swell, prices of derivatives instruments might fluctuate dramatically, affecting market stability. This scenario is particularly concerning in derivatives markets where leveraging is prevalent, as the amplification of price movements can lead to substantial financial distress for market participants.

Moreover, regulatory compliance challenges arise when integrating blockchain solutions within financial derivatives. Traditional regulatory frameworks may not adequately address the unique characteristics of blockchain technologies, leading to uncertainties in compliance and enforcement. Regulators are navigating uncharted territory, which can result in varied and inconsistent regulatory approaches across jurisdictions. Companies involved in financial derivatives must remain vigilant and proactive in ensuring adherence to regulatory standards, as lapses could invoke severe penalties and reputational damage.

Finally, the potential for systemic risks cannot be overlooked. Given the interconnected nature of financial systems, failures or vulnerabilities within blockchain technology could trigger widespread ramifications across the derivatives landscape and beyond. Assessing these risks is essential for stakeholders to develop robust strategies that promote resilience and stability while harnessing the benefits of blockchain innovations in financial derivatives.

Stay informed, read the latest crypto news in real time!

Conclusion: The Path Forward

The advancement of blockchain technology is poised to revolutionize the landscape of financial derivatives, offering unprecedented opportunities for efficiency, transparency, and security. Key points in this discourse highlighted how the inherent characteristics of blockchain—decentralization, immutability, and real-time settlement—can address many of the inefficiencies currently prevalent in the derivatives market. By eliminating the need for intermediaries, blockchain technology simplifies transactions, reduces costs, and accelerates processing times, thereby enhancing liquidity and driving innovation within the sector.

Furthermore, as transaction records are securely and transparently maintained on the blockchain, the potential for fraud and manipulation diminishes significantly. This increased trust in the data fosters a more stable environment for trading financial derivatives. Stakeholders, including financial institutions, regulators, and investors, must actively engage with this technology to stay competitive. Continuous education about blockchain’s implications and its integration into existing systems will be essential for adaptation. Additionally, collaboration between technology providers and regulatory bodies will ensure that adequate safeguards are established. Only through such synergetic efforts can we foster a regulatory landscape that encourages innovation while protecting market participants.

As we move forward, it is critical for industry players to remain agile and open-minded regarding the adoption of blockchain solutions. By embracing these changes, stakeholders can leverage blockchain not merely as a trend but as a foundational element that enhances their strategies in handling financial derivatives. This proactive approach will not only safeguard their positions in the evolving market but also empower them to unlock new avenues for growth and profitability amidst the ongoing transformation in the financial sector.

One thought on “Revolutionizing Finance: The Impact of Blockchain on Financial Derivatives”