Trump’s Bold Move: Why the US Canceled CBDC in Favor of Stablecoins

The financial world is abuzz with the United States’ recent decision to cancel plans for a central bank digital currency (CBDC). This monumental move, led by former President Donald Trump, highlights a strategic shift toward dollar-backed stablecoins. The decision reflects America’s commitment to innovation, financial independence, and safeguarding individual privacy.

In this article, we will delve into the reasoning behind this decision, its implications, and what the future holds for the United States in the digital financial landscape.

Table of Contents

1. The Controversy Around CBDC

CBDC, a digital form of currency issued by central banks, has gained traction worldwide. However, it has also sparked significant controversy, particularly concerning its implications for personal privacy. Critics argue that CBDCs provide central authorities with an unprecedented level of control over individuals’ financial activities.

For this reason, the United States has chosen a different path, prioritizing stablecoins over CBDC.

2. Why Did the US Cancel CBDC Plans?

The decision to cancel central bank digital currency plans is rooted in concerns about privacy, stability, and personal freedoms. Unlike CBDC, which would enable extensive governmental oversight, stablecoins offer a decentralized alternative that preserves user autonomy.

Stablecoins are pegged to the US dollar, providing the stability of fiat currency while offering the flexibility of digital assets. This aligns with the nation’s goals to promote innovation and maintain financial independence.

3. Stablecoins: The Preferred Alternative

Trump’s executive order underscores the US preference for stablecoins as a cornerstone of its digital financial strategy. These dollar-backed tokens bridge the gap between traditional banking systems and modern digital finance.

Stablecoins eliminate the instability often associated with other cryptocurrencies, providing a reliable digital option while supporting financial inclusion.

4. Legal Protections for Blockchain Innovation

The executive order emphasizes legal protections for blockchain and digital asset players. By removing restrictive regulations, the US is fostering an environment where innovation can thrive.

For instance, businesses and individuals in the blockchain space now have the freedom to create and implement technologies without burdensome legal hurdles.

5. Financial Freedom and Self-Custody

One of the key highlights of the order is the emphasis on self-custody services. These services empower users to manage their digital assets independently, ensuring they retain control over their finances.

In contrast to CBDC, which could centralize control, self-custody solutions provide a way for individuals to safeguard their resources without government intervention.

6. The Role of the President’s Working Group on Digital Asset Markets

The establishment of the President’s Working Group on Digital Asset Markets is a significant step. Headed by David Sacks, this group is tasked with creating a legislative framework that promotes the growth of the crypto market.

Their findings, expected within 180 days, aim to provide regulatory clarity, enabling industry players to innovate without fear of ambiguous laws.

7. Implications for the US Dollar

Dollar-backed stablecoins are seen as a tool to strengthen the US dollar’s position as the dominant global currency. By focusing on stablecoin innovation, the US can maintain its financial influence while avoiding the pitfalls of CBDC.

This approach also demonstrates a commitment to safeguarding personal financial freedom.

8. CBDC vs. Stablecoins: Key Differences

| Aspect | CBDC | Stablecoins |

|---|---|---|

| Control | Centralized by government | Decentralized |

| Privacy | Limited | Preserved |

| Value Stability | Stable, but government-controlled | Pegged to fiat, user-controlled |

| Innovation | Restricted | Encouraged |

9. Addressing Privacy Concerns

Privacy has become a growing concern with CBDC adoption. Critics fear it could enable invasive government surveillance.

In contrast, stablecoins provide a system where users retain privacy without compromising functionality. This balance is a cornerstone of the US digital finance strategy.

10. The Global Perspective on CBDC

While many nations are pursuing CBDC development, the US stands out with its rejection of this trend. This decision sets a precedent for other countries reconsidering the trade-offs associated with CBDC.

11. Economic Competitiveness Through Stablecoins

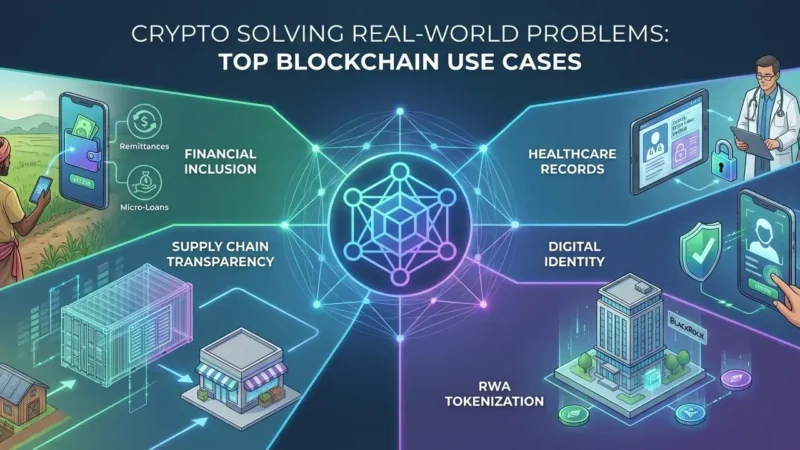

The shift to stablecoins allows the US to remain competitive in the global financial landscape. By encouraging innovation, the country aims to attract top talent and investment in the blockchain space.

12. The Ethical Dimension

Ethical considerations play a significant role in this decision. Concerns over CBDC misuse have fueled debates about its potential impact on individual rights. By opting for stablecoins, the US aligns with ethical practices that prioritize freedom and transparency.

13. Legislative Clarity and Innovation

Trump’s order seeks to eliminate ambiguous rules that stifle creativity in the digital asset space. Clear regulations are crucial for fostering innovation and attracting industry leaders.

14. Addressing Global Financial Inclusion

Stablecoins offer a path to enhance financial inclusion on a global scale. Their accessibility and reliability make them an ideal solution for underserved populations.

15. Future Outlook for US Digital Finance

The US’s decision to abandon CBDC in favor of stablecoins reflects a forward-thinking approach. By prioritizing innovation, privacy, and financial freedom, the country is setting the stage for a competitive and inclusive digital economy.

16. Frequently Asked Questions (FAQs)

Q1: What is CBDC?

CBDC stands for Central Bank Digital Currency, a digital version of a nation’s fiat currency issued and regulated by its central bank.

Q2: Why did the US cancel CBDC plans?

The US canceled CBDC plans due to concerns about privacy, governmental control, and its potential misuse as a surveillance tool.

Q3: How do stablecoins differ from CBDC?

Stablecoins are decentralized, pegged to fiat currencies like the US dollar, and preserve user privacy, unlike the centralized and controlled nature of CBDC.

Q4: What is the President’s Working Group on Digital Asset Markets?

This group, led by David Sacks, is tasked with creating a legislative framework to foster crypto innovation while ensuring regulatory clarity.

Q5: How does this decision impact the US dollar?

Focusing on stablecoins strengthens the US dollar’s global position by promoting a competitive and innovative digital financial environment.

Q6: What are self-custody services?

Self-custody services allow individuals to manage their digital assets independently without relying on third parties or governmental control.

Stay informed, read the latest crypto news in real time!

Conclusion

The United States’ decision to cancel CBDC plans in favor of stablecoins marks a pivotal moment in digital finance. By prioritizing innovation, privacy, and financial independence, the US is paving the way for a future where the digital economy thrives without compromising individual freedoms.

As global financial landscapes evolve, the US’s approach serves as a compelling model for balancing progress with personal rights.