Cathie Wood’s Stark Warning: Memecoins Facing Imminent Collapse Amid Speculation and Regulatory Void

The volatile world of cryptocurrency has once again been shaken by a stark warning from a prominent figure. Cathie Wood, the CEO of Ark Invest, has issued a dire prediction about the future of memecoins, asserting that the vast majority of these digital assets are destined for collapse. Her concerns stem from a confluence of factors, including rampant speculation, a lack of fundamental value, and a glaring absence of regulatory oversight.

Wood’s Analysis: Lack of Fundamental Value and Reliance on Speculation

In a recent interview with Bloomberg Television, Wood painted a picture of a market saturated with tokens generated through the combined power of artificial intelligence and blockchain technology. While these technologies hold immense potential, she argues that their application in the creation of many memecoins has resulted in assets devoid of tangible utility.

“We’re seeing a proliferation of tokens being created, and many of them lack any real purpose,” Wood stated. “They’re driven by hype and speculation, and that’s a recipe for disaster.”

The $Trump Token Example: A Case Study in Volatility

The recent trajectory of the $Trump token serves as a stark illustration of this volatility. After an initial surge fueled by fervent speculation, the token experienced a dramatic crash, leaving many investors with substantial losses. This episode underscores the inherent risks associated with investing in assets that lack intrinsic value and are susceptible to rapid price swings.

Regulatory Void: The Absence of SEC Oversight

Wood’s concerns are further amplified by the lack of regulatory clarity surrounding memecoins. She highlighted that the U.S. Securities and Exchange Commission (SEC) has yet to establish a comprehensive framework for regulating these tokens. This regulatory vacuum leaves investors exposed to potential fraud and market manipulation, as there are no safeguards in place to ensure fair and transparent trading practices.

“The absence of regulation creates a breeding ground for bad actors,” Wood warned. “Investors need to be aware that they are essentially operating in a Wild West environment.”

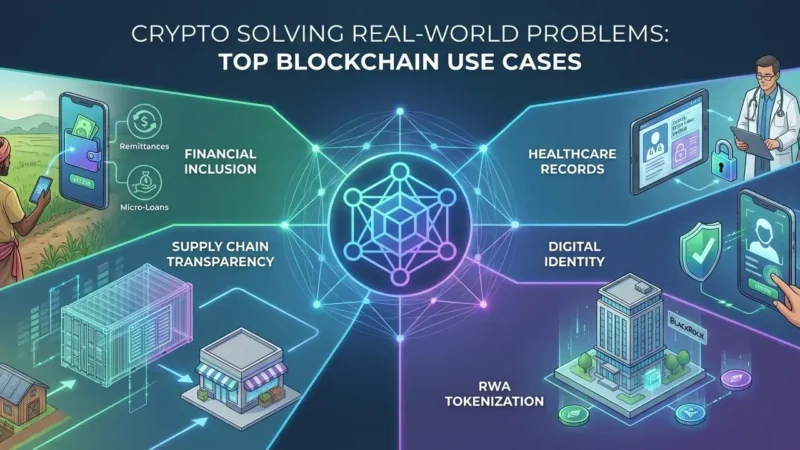

Bitcoin, Ethereum, and Solana: Demonstrating Real-World Utility

In contrast to the precarious position of memecoins, Wood pointed to the continued growth and adoption of established cryptocurrencies like Bitcoin, Ethereum, and Solana. These assets have distinguished themselves by demonstrating real-world utility and attracting institutional backing.

The Rise of Established Cryptocurrencies: Institutional Backing and Real Applications

Bitcoin, the pioneer of cryptocurrency, has solidified its position as a store of value and a hedge against inflation. Ethereum, with its smart contract capabilities, has become the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs). Solana, known for its high throughput and low transaction fees, has emerged as a leading platform for decentralized applications (dApps).

Market Scrutiny and the Need for Transparency

Wood’s warning about memecoins comes at a time when the cryptocurrency market is grappling with increased scrutiny from regulators and investors alike. The recent collapse of several high-profile cryptocurrency projects has underscored the need for greater transparency and accountability within the industry.

The Proliferation of Memecoins: A Breeding Ground for Potential Pitfalls

The surge of new tokens, especially those marketed as memecoins, has created an environment rife with potential pitfalls. Many of these tokens are launched with minimal development and no clear roadmap, relying solely on social media hype to attract investors.

The “X-2-Earn” Model: A Sustainable Approach to Web3 Adoption

The “X-2-Earn” model, pioneered by projects like VeChain, has shown that incentivizing sustainable content creation can drive Web3 adoption. This model, which rewards users for contributing to the ecosystem, offers a more sustainable approach to building value in the cryptocurrency space.

Overcoming the Perception of Speculative Bubbles

However, the proliferation of memecoins has overshadowed these positive developments, creating a perception that the cryptocurrency market is dominated by speculative bubbles. Wood’s warning serves as a timely reminder that investors must exercise caution and conduct thorough due diligence before investing in any digital asset.

The Challenge of Regulatory Gaps and Investor Protection

The lack of regulation surrounding memecoins poses a significant challenge for investors. Without clear guidelines and oversight, it is difficult to distinguish between legitimate projects and scams. This regulatory void also hinders the development of institutional-grade infrastructure for trading and custody of these assets.

Focus on Real-World Solutions and Long-Term Viability

The long term viability of the crypto market depends on the establishment of clear regulation, and a focus on projects that provide real world solutions. Many projects that are not memecoins are working hard to provide those solutions.

Differentiation Between Hype and Utility: The Key to Sustainable Growth

The market needs to differentiate between those assets that are built on hype, and those that are built on utility.

Stay informed, read the latest crypto news in real time!

Conclusion: Prioritizing Fundamentals and Exercising Caution

In conclusion, Cathie Wood’s warning about the impending collapse of most memecoins should serve as a wake-up call for investors. The cryptocurrency market is evolving rapidly, and it is crucial to focus on assets that offer genuine value and demonstrate long-term potential. While the allure of quick profits may be tempting, investors must prioritize fundamentals and exercise caution in this volatile landscape. The future of cryptocurrency lies in building a sustainable and regulated ecosystem, where innovation and integrity go hand in hand.