Story’s IP Token Shines Amidst Crypto Market Downturn

In a period where the broader cryptocurrency market often appears to be navigating turbulent waters, Story’s IP token stands out as a beacon of resilience and growth. While many major altcoins struggle to maintain momentum, the IP token has not only defied the sluggish market sentiment but has also posted impressive gains, capturing the attention of investors and traders alike. Its recent performance, including a significant daily surge and consistent upward trajectory, suggests robust underlying conviction and a potential for further advancement.

Impressive Performance Metrics

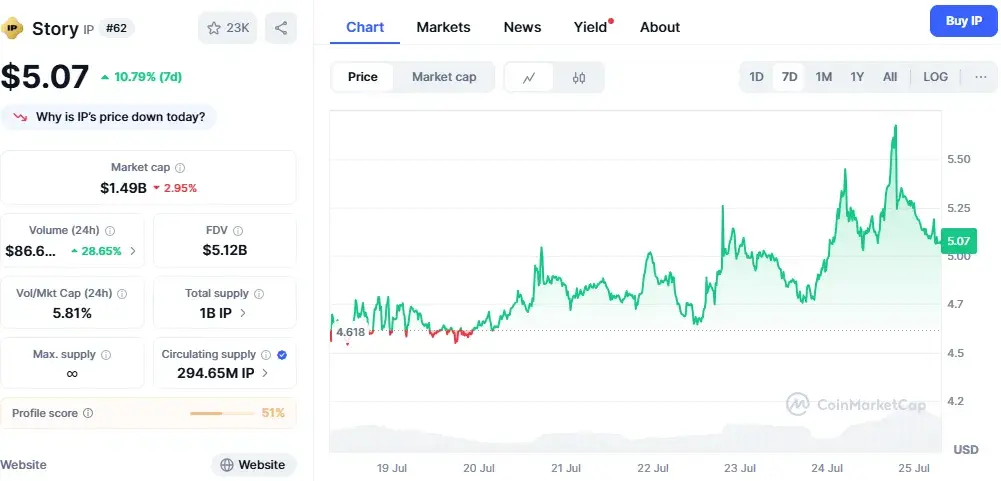

The IP token’s ability to swim against the current is clearly reflected in its performance metrics. Over the past 24 hours, it has recorded a notable 9.29% daily gain, cementing its position above the critical $5.20 mark. This upward movement is not an isolated incident; the IP token has demonstrated a consistent climb, adding over 20% in just one week, now trading steadily at $5.23. This price action has solidified its standing above a level that market participants have been closely monitoring since March, indicating a strong foundation for future growth.

Beyond its price action, other indicators underscore the IP token’s robust health. Its market capitalization has reached an impressive $1.54 billion, positioning it firmly among the more significant mid-cap altcoins. This substantial valuation, coupled with a remarkable increase in trading activity, paints a clear picture of escalating investor interest.

Surging Volume and Investor Conviction

A crucial element contributing to the IP token’s upward momentum is its rapidly expanding trading volume. Market observers have highlighted that the daily trading volume for the IP token soared to $83.83 million within the last 24 hours, marking a substantial 31.2% increase. This surge in volume is particularly telling as it indicates a significant influx of fresh capital. Despite general profit-taking trends observed across the wider crypto market, new funds continue to pour into the IP token, reflecting strong and sustained investor conviction.

This inflow of capital is further evidenced by consistent spot inflows, which have topped $5 million this week. Such sustained inflows are a powerful testament to the confidence investors have in the IP token’s potential, choosing to allocate significant resources even when other assets are experiencing pullbacks. The combination of increasing volume and positive spot inflows creates a fertile ground for continued price appreciation.

Technical Strength and Bullish Sentiment

The technical analysis of the IP/USD chart provides additional layers of confidence for bulls. The IP token has firmly established and maintained an ascending trendline that originated on July 11. This consistent structure, characterized by a clear pattern of higher lows, is a highly encouraging signal for buyers, suggesting that the asset is in a sustained uptrend. For traders, this technical resilience indicates that the IP token is well-positioned for further upward movement.

The immediate focus for traders now shifts towards overcoming the next significant resistance level, which is situated near the March peak of $5.59. This target becomes increasingly attainable if the IP token continues to successfully defend the crucial $4.92 level, which it recently breached. The ability to hold above this level is paramount for sustaining the current bullish narrative and paving the way for a retest of historical highs.

Futures Market Backing and Positive Funding Rates

The optimism surrounding the IP token is not confined to the spot market; futures traders are also signaling strong bullish sentiment. Since July 20, the IP token has maintained a steady positive funding rate in the futures market. A positive funding rate implies that traders holding long positions are paying a premium to maintain those positions. This mechanism is a strong indicator that the vast majority of futures traders anticipate further price appreciation, willing to incur costs in expectation of future gains. Such widespread bullish conviction in the derivatives market provides a significant vote of confidence that the current momentum may not dissipate anytime soon.

While there have been instances of profit-taking, such as a modest $157,000 net outflow from some wallets today, the broader market sentiment remains overwhelmingly upbeat. This minor outflow is viewed by many as a healthy correction within an uptrend rather than a sign of weakness. Bulls are actively interpreting any potential pullback towards the $4.92 level as a prime opportunity to “reload” their positions, reinforcing their holdings before the next projected upward leg. This resilient attitude among investors suggests a deep-seated belief in the IP token’s long-term trajectory.

Market Capitalization Growth and Fundamental Strength

Story’s IP token has achieved a substantial market capitalization of $1.54 billion, a milestone that significantly bolsters its standing within the competitive landscape of mid-cap altcoins. This increased market cap not only attracts further investor interest but also solidifies its credibility as a robust and growing asset. For a significant segment of the investment community, the IP token’s recent rally serves as compelling evidence that strong fundamentals, coupled with disciplined accumulation strategies, are capable of driving a token’s value higher, even when faced with adverse broader market conditions.

Stay informed, read the latest crypto news in real time!

This fundamental strength, combined with the continuous influx of fresh capital, positions the IP token for further challenges and potential breakthroughs. The next major test for the IP token will be its ability to reclaim and sustain its March high of $5.59. This will be a closely watched event by both traders and investors, who will be keenly observing whether spot inflows remain consistent and futures funding rates continue to stay positive in the days and weeks ahead. The confluence of these factors will be crucial in determining the IP token’s ability to not only retest but potentially surpass its previous peak, further cementing its status as a market leader in a challenging environment. The narrative around the IP token is one of resilience, robust growth, and strong investor belief, painting a promising outlook for its future performance.