Digital Assets See Record Inflows as Ethereum Leads Altcoin Surge

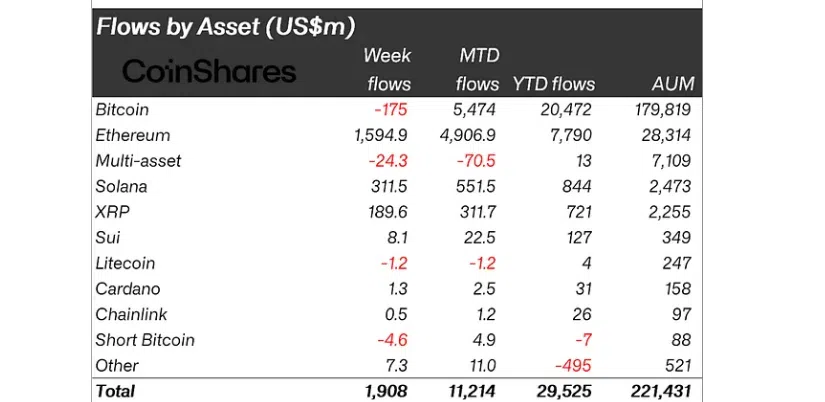

The landscape of digital asset investment is experiencing an unprecedented boom, with fresh capital pouring into the market at a record-breaking pace. Last week alone, digital asset investment products attracted a staggering $1.9 billion, catapulting July’s total inflows to an all-time high of $11.2 billion. This remarkable surge significantly outpaces the previous record set in December 2024, which followed the US elections, signaling a robust and sustained investor appetite for the crypto market.

This impressive streak marks the 15th consecutive week of net inflows, demonstrating a resilient and growing confidence in digital assets. While Bitcoin has been the traditional powerhouse, recent trends indicate a noteworthy shift in investor sentiment, with altcoins, particularly Ethereum, emerging as the primary drivers of this growth.

Ethereum’s Dominance in the Current Cycle

Ethereum has undeniably taken center stage, attracting an astounding $1.59 billion in just seven days. This strong momentum has pushed Ethereum’s year-to-date inflows to nearly $7.8 billion, already surpassing its entire total for 2024. This performance underscores a clear shift in institutional and retail interest, with many seeing Ethereum as a compelling alternative and a potential hedge against Bitcoin’s recent consolidation.

While Bitcoin did register mild outflows of $175 million last week—likely attributed to profit-taking ahead of anticipated ETF developments—altcoins stepped confidently into the spotlight. Beyond Ethereum, other select altcoins have also garnered significant attention, indicating a broader diversification of portfolios within the digital asset space. Solana, for instance, attracted a substantial $311 million, while XRP added $189 million. Even smaller but promising names like SUI managed to pull in a respectable $8 million, showcasing a willingness among investors to explore beyond the traditional top-tier cryptocurrencies.

However, it’s crucial to note that this altcoin surge isn’t a tide lifting all boats. Litecoin and Bitcoin Cash both experienced outflows, suggesting a more discerning approach from investors. The capital is now increasingly focused on projects with clear development roadmaps, robust ecosystems, and tangible utility. This selective allocation could signal the early stages of a more refined altcoin cycle, moving away from broad speculative rallies towards more fundamentally driven investments.

Regional Trends and Regulatory Optimism

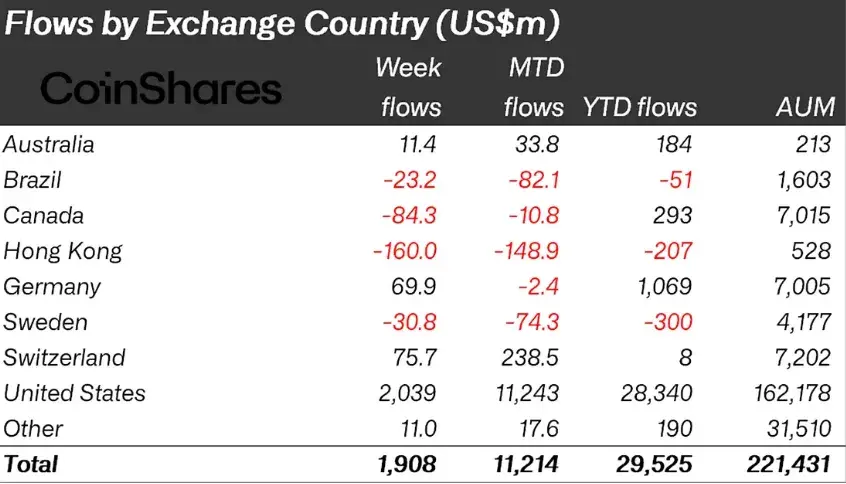

Geographical analysis of these inflows reveals a clear preference for regions offering greater regulatory predictability and deeper liquidity. North America, especially the United States, stands out, contributing approximately $2 billion in inflows last week. This is largely fueled by continued optimism surrounding regulatory clarity, particularly the ongoing discussions and potential approvals of new spot exchange-traded funds (ETFs) for various digital assets.

Europe is also a significant player, with Germany adding another $70 million in inflows. Conversely, smaller markets such as Brazil, Canada, and Hong Kong reported modest outflows. This divergence highlights a global trend: investors are gravitating towards jurisdictions that provide more predictable regulatory frameworks, fostering a safer and more attractive environment for large-scale digital asset investments. The anticipation of further regulatory clarity in major economies is a key factor sustaining this positive momentum and drawing in traditional financial players.

Maturing Market: New Players and Future Prospects

The current upward trend in digital asset investments is not merely driven by existing crypto enthusiasts. A crucial factor sustaining this momentum is the increasing participation from a broader spectrum of institutional investors. Pension funds, family offices, and even some sovereign wealth funds are now actively exploring and entering the digital asset market. This influx of sophisticated capital is boosting liquidity and, perhaps more importantly, raising confidence that digital assets are maturing into a legitimate and enduring mainstream investment class. This growing institutional endorsement is a powerful signal of the asset class’s increasing credibility and long-term viability.

Looking ahead, market participants widely anticipate this upward trajectory to continue. The ongoing development of network upgrades, the increasing adoption of layer-2 scaling solutions, and the continuous innovation within decentralized finance (DeFi) projects are expected to attract even more capital flows. DeFi, in particular, continues to offer compelling opportunities for higher returns compared to traditional asset classes, drawing in capital from investors seeking diversification and yield in an environment where conventional markets remain volatile.

Stay informed, read the latest crypto news in real time!

As global economies navigate uncertain waters and traditional markets exhibit volatility, digital assets are proving to be a resilient, adaptive, and increasingly attractive option for forward-looking investment portfolios worldwide. The relentless pace of innovation within the blockchain space, coupled with growing institutional acceptance and clearer regulatory pathways, suggests that digital assets are not just a passing trend but a foundational shift driving innovation across the entire financial ecosystem. The current wave of inflows signifies a market confidently moving towards its next phase of significant growth and broader integration into the global financial fabric.

One thought on “Digital Assets See Record Inflows as Ethereum Leads Altcoin Surge”