Blockchain News 2025: The Future of Decentralization

Introduction to Blockchain in 2025

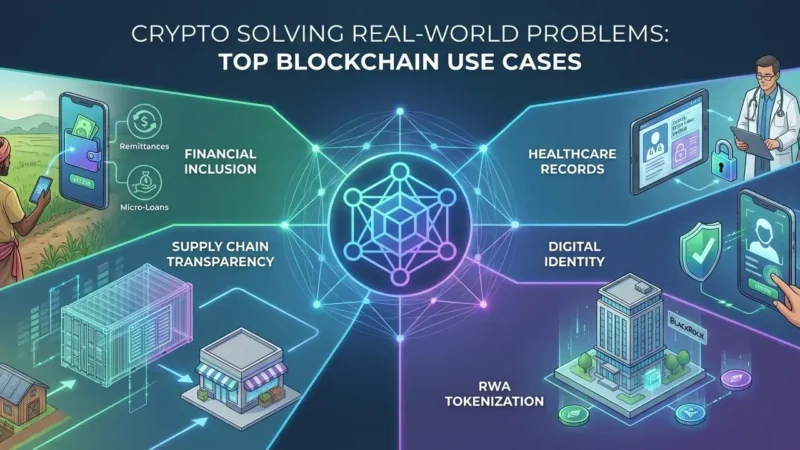

As we step into 2025, the landscape of blockchain technology has evolved significantly, solidifying its status as a pivotal component of modern digital infrastructure. Blockchain news has been remarkable over the past few years, driven by the growing demand for secure, transparent, and efficient systems across a variety of industries. Originally, blockchain was primarily associated with cryptocurrencies, but its capabilities now extend far beyond digital currencies to include applications in finance, healthcare, supply chain management, and even governance.

Table of Contents

In 2025, blockchain technology is well-established, with numerous successful implementations demonstrating its effectiveness in delivering trust and accountability. Smart contracts, which automatically execute transactions when predetermined conditions are met, have gained widespread adoption, drastically reducing the need for intermediaries and streamlining processes. Moreover, the integration of blockchain with other technologies such as artificial intelligence and the Internet of Things (IoT) has opened up new avenues for innovation and operational efficiency.

Furthermore, as concerns over data privacy and security continue to mount, blockchain serves as an essential tool for safeguarding sensitive information. The immutability and decentralized nature of blockchain make it an attractive solution for organizations seeking to enhance data integrity and mitigate fraudulent activities. Industries such as healthcare are leveraging blockchain to securely manage patient records, ensuring interoperability while protecting individual privacy.

In summary, the landscape of blockchain technology in 2025 reflects a maturation of technology that has transcended its initial purpose. The ongoing development of blockchain news reveals not only the increasing number of applications but also the broader acceptance of decentralized systems across various sectors. As we delve deeper into this year’s advancements and emerging trends, it becomes clear that blockchain is transforming the traditional frameworks of businesses and institutions alike.

Key Innovations and Technological Advances

By 2025, the landscape of blockchain technology has witnessed significant advancements that are reshaping its functionality and applications. One of the most notable breakthroughs is in scalability, which has been a long-standing challenge for many blockchain networks. New Layer 2 solutions, such as Rollups and Sidechains, have emerged, facilitating faster transaction processing rates while drastically reducing fees. This allows networks to cater to a growing user base without compromising on performance, fundamentally enhancing user experience across various decentralized applications.

Interoperability has also seen a considerable leap forward, with projects focusing on cross-chain functionality. Initiatives such as Polkadot and Cosmos have paved the way for seamless communication between different blockchain networks, enabling assets and data to be easily transferable. This cross-chain capability not only enhances user experience but also promotes collaboration between diverse ecosystems, fostering innovation and utility of decentralized technologies in multiple sectors.

Security features in blockchain technology have advanced significantly, thanks to the integration of new cryptographic techniques and robust consensus mechanisms. Traditional Proof of Work and Proof of Stake models are being complemented by alternatives such as Proof of Authority and Delegated Proof of Stake, which increase efficiency while maintaining decentralization. These new mechanisms not only enhance security but can also optimize energy usage, addressing one of the major criticisms of blockchain technology. As a result, users can engage with blockchain platforms with greater confidence in their security.

In summary, the major innovations and technological advances in blockchain by 2025 have set the foundation for a more scalable, interoperable, and secure environment. These enhancements promise to have a profound impact on the overall performance and user experience in the blockchain ecosystem, opening new avenues for adoption and application in various domains.

Regulatory Landscape and Compliance

The regulatory landscape surrounding blockchain technology is rapidly evolving, particularly as we approach 2025. Governments and regulatory bodies globally are increasingly recognizing the significance of blockchain and its potential to disrupt traditional financial systems. As a result, they are implementing new legislation and compliance frameworks aimed at managing the integration of blockchain technologies and cryptocurrencies into the mainstream economy.

In many jurisdictions, regulatory authorities are striving to strike a balance between fostering innovation and ensuring consumer protection. This has led to the introduction of a variety of new laws that govern aspects such as digital asset securities, anti-money laundering (AML), and know-your-customer (KYC) regulations. The goal is to create an environment in which blockchain technology can thrive while mitigating potential risks associated with fraud or illicit activities. In the United States, for instance, the SEC and CFTC are actively collaborating to provide clearer guidelines that would encourage compliance among blockchain developers and cryptocurrency exchanges.

Internationally, the approach to regulation reflects distinct cultural and economic priorities. Countries like Switzerland have embraced blockchain technology, establishing “Crypto Valleys” and creating friendly regulatory environments to attract innovation. In contrast, some nations have adopted stricter measures, imposing bans or severe restrictions on cryptocurrency transactions. Such divergent regulatory attitudes highlight the necessity for businesses operating in the blockchain space to remain vigilant about jurisdictional compliance and to adapt their strategies accordingly.

The ongoing evolution of blockchain news is crucial for stakeholders across the ecosystem. As regulations continue to unfold, companies must stay informed and proactive, ensuring not only compliance but also the ability to harness the opportunities presented by blockchain technology. By closely monitoring regulatory changes, they can successfully navigate the complexities of compliance while contributing to the sustainable growth of this transformative industry.

Blockchain in Finance: Trends and Developments

As we progress towards 2025, the integration of blockchain technology within the financial sector has become increasingly evident, changing the landscape of how financial transactions are conducted. A noteworthy trend is the rise of Central Bank Digital Currencies (CBDCs), which aims to enhance the efficiency and security of monetary exchanges. Many central banks around the world are exploring the potential of CBDCs; this includes piloting projects aimed at improving payment systems and reducing transaction costs. These digital currencies are positioned to complement existing physical currencies and tackle challenges surrounding stability and inflation.

Simultaneously, Decentralized Finance (DeFi) platforms have been gaining traction, offering alternative solutions to traditional banking systems. DeFi leverages blockchain technology to enable permissionless financial transactions and services, such as lending and borrowing, without the need for an intermediary. The rise of smart contracts has further fortified this sector, enabling self-executing agreements that enhance transparency and reduce costs. As more users become aware of DeFi platforms, the shift towards the decentralization of financial services appears inevitable, creating robust alternatives to conventional banking practices.

Moreover, partnerships between traditional financial institutions and blockchain startups are becoming more prevalent as industry players recognize the advantages of blockchain integration. Collaborative efforts have led to innovations in various aspects of finance, including cross-border payments, trade finance, and identity verification systems. For example, major banks are investing in blockchain-based trade finance solutions that significantly improve transaction times and reduce fraud risks. These developments not only reflect the growing acceptance of blockchain technology but also underscore its transformative potential within the finance sector.

As we move towards 2025, observing these significant trends will provide valuable insight into how blockchain news evolves and shapes the financial industry, paving the way for a more decentralized future.

Impact of Blockchain on Supply Chain Management

The influence of blockchain technology on supply chain management is becoming increasingly significant, with predictions for substantial advancements by 2025. As businesses seek to enhance their operations, the adoption of blockchain solutions promises considerable improvements in transparency, traceability, and efficiency. One of the primary advantages of implementing blockchain in supply chains is the ability to create an immutable ledger. This ledger enables parties involved in the supply chain to access real-time data, ensuring that they have accurate information regarding product origins, shipping status, and transaction histories.

Several organizations are already harnessing the power of blockchain to optimize their supply chain processes. For instance, Walmart has adopted blockchain technology to enhance food safety by tracking the journey of products from farm to store. In doing so, the company can pinpoint sources of contamination more swiftly, reducing waste and ensuring the well-being of consumers. Similarly, Maersk has partnered with IBM to create a blockchain-based system called TradeLens, which promotes interoperability among various stakeholders in international shipping. This initiative aims to improve efficiency by reducing the complexities associated with document verification while enhancing overall supply chain transparency.

Despite the numerous benefits, challenges remain in the widespread implementation of blockchain within supply chain management. Issues such as scalability, energy consumption, and regulatory uncertainty have the potential to impede progress. Additionally, various stakeholders must agree on standards and protocols to create a unified approach towards blockchain integration. Nevertheless, as these challenges are addressed, the potential for blockchain to revolutionize supply chain management becomes even more evident. Companies will not only benefit from improved operational efficiency but will also enhance their responsiveness to consumer demands, ultimately fostering a more resilient global supply chain.

Blockchain and the Rise of NFTs: 2025 Edition

As we look towards 2025, the landscape of non-fungible tokens (NFTs) has expanded significantly, illustrating the dynamic evolution of blockchain technology. Initially popularized through digital art, NFTs are now seamlessly integrated into various sectors such as gaming, music, and real estate. This diversification illustrates the potential of blockchain technology to transform numerous industries by providing unique verification of ownership and authenticity.

In the gaming industry, NFTs have taken center stage, with developers utilizing blockchain technology to create in-game assets that players can truly own. This has led to an unprecedented surge in fan engagement as players can buy, sell, and trade their virtual items. Platforms dedicated to gaming NFTs have emerged, allowing for greater interoperability between games. Players can now carry their characters and items across different platforms, significantly enriching the gaming experience.

Similarly, the music industry has embraced NFTs, enabling artists to sell their work directly to fans while retaining greater control over their intellectual property. Musicians are now creating exclusive album releases or offering limited-edition merchandise as NFTs, thereby fostering deeper connections with their audience. The incorporation of smart contracts further enhances the benefits for artists, ensuring that they receive royalties every time their work is resold.

Real estate is another domain witnessing the impact of NFTs. Property ownership records can be tokenized on a blockchain, streamlining transactions and providing a transparent ledger of ownership history. This innovation not only mitigates the risk of fraud but also allows for fractional ownership, making real estate investments accessible to a broader audience.

While the exciting advancements in NFT technologies are apparent, debates surrounding intellectual property rights and ownership continue to surface. As the market grows, the challenge of determining ownership and rights associated with digital creations remains prominent, necessitating rigorous discussions within the blockchain community. These concerns must be addressed to pave the way for future innovations in NFTs and ensure sustainable growth in this evolving sector.

Decentralized Governance and DAO Evolution

Decentralized Autonomous Organizations (DAOs) have witnessed significant evolution since their inception, playing a crucial role in shaping the landscape of blockchain news and decentralized governance. By 2025, DAOs are anticipated to have gained substantial traction across various sectors, ranging from finance to social impact initiatives. The principles underlying decentralized governance focus on transparency, inclusivity, and community-driven decision-making, which empower stakeholders to engage actively in the management and direction of projects.

One of the key advantages of DAOs is their ability to operate without a central authority, relying instead on smart contracts to enforce rules and facilitate interactions among members. This structure promotes accountability, as decisions are made collectively and recorded transparently on the blockchain. As DAOs continue to grow and mature, several successful models have emerged, each adapting to specific industry needs. Examples include venture capital DAOs, which allow members to pool resources and make collective investment decisions, and governance DAOs focusing on managing community resources or protocol upgrades.

However, the rapid evolution of DAOs is not without challenges. Issues surrounding decision-making processes, the need for effective governance frameworks, and the accountability of members remain areas of concern. In addition, ensuring that all voices are heard and adequately represented can be complicated in larger organizations, which may lead to fragmentation. Nonetheless, ongoing innovations in governance models, such as quadratic voting and reputation systems, aim to address these challenges while maintaining the core principles of decentralization.

As we approach 2025, the future outlook for DAOs remains optimistic, with growing adoption anticipated across various sectors. Continued advancements in blockchain technology and increased awareness of decentralized governance principles stand to drive the evolution of DAOs, further influencing the way decentralized systems operate. The ripple effects of these developments are likely to remain a focal point in blockchain news, as the community explores the implications and potentials of DAOs in the broader context of decentralization.

Public Sentiment and Adoption Trends

As we enter the year 2025, public sentiment towards blockchain technology and cryptocurrencies appears to be markedly more favorable than in previous years. Over the last decade, significant advancements in blockchain applications and a greater understanding of its potential have led to a shift in perspectives. Surveys conducted by various market research firms indicate that a growing percentage of the population recognizes blockchain as a legitimate technology, with respondents often citing the transparency and security features as compelling advantages.

In 2025, adoption rates among businesses are considerably higher than in earlier years. Many companies have integrated blockchain solutions into their operations, ranging from supply chain management to secure data storage. This trend has been fueled by increased awareness of the technology’s benefits, including improved efficiency and reduced costs. Furthermore, businesses that initially approached blockchain with skepticism are now more likely to explore its applications, primarily due to case studies showcasing successful implementations. Expert opinions reflect a consensus that the fears surrounding regulatory issues and volatility have decreased, thus spurring interest and investment in blockchain technologies.

Consumer attitudes also reflect an increasingly positive outlook. Polls reveal that more individuals are willing to engage with cryptocurrencies, not only as investments but also as a means of transaction. The emergence of user-friendly digital wallets and payment systems has facilitated this transition, lowering barriers for everyday users. Educational initiatives focused on blockchain usage and its potential impact on various industries have further demystified the technology, fostering a culture of innovation and curiosity among consumers. Overall, the combination of increased business adoption and favorable consumer sentiment suggests that blockchain technology is on track to become a significant and trusted component of the digital economy going forward.

Conclusion: The Road Ahead for Blockchain

The future of blockchain technology holds immense promise and the potential to reshape various sectors significantly. As we have explored throughout this blog post, blockchain is not merely a trend but a transformative force driving innovation and decentralization. The future trajectories of blockchain are influenced by various factors, including regulatory developments, technological advancements, and market demands. Each of these elements plays a critical role in shaping the landscape of blockchain news as we move toward 2025 and beyond.

One of the major challenges that the blockchain ecosystem faces is regulatory compliance. Governments and regulatory bodies around the world are grappling with how to manage the rapidly evolving nature of blockchain technology. The outcome of these discussions will undoubtedly influence the adoption rates and integration of blockchain across different industries. Consequently, staying informed about any changes in regulations will be vital for stakeholders, developers, and enthusiasts alike.

Opportunities abound as well, particularly in sectors such as finance, supply chain management, healthcare, and even voting systems. The ability of blockchain to streamline processes, enhance security, and provide unprecedented transparency positions it as a fundamental pillar in addressing challenges faced by these industries. Continuous advancements in blockchain applications and innovations, including decentralized finance (DeFi) and non-fungible tokens (NFTs), demonstrate that the technology’s versatility is poised to expand even further.

Stay informed, read the latest crypto news in real time!

In conclusion, remaining updated with blockchain news is crucial for anyone interested in the ongoing evolution of this technology. The potential applications are vast, and its impact will only grow more profound as we navigate the future of decentralization. By educating ourselves and engaging with the Blockchain community, we can better prepare for the changes ahead and take advantage of the myriad opportunities that this technology presents.