Understanding the Different Types of Crypto Tokens

Introduction to Crypto Tokens

Crypto tokens are a fundamental part of the blockchain ecosystem, representing various assets or utilities that are built on existing blockchain networks. Unlike cryptocurrencies, which typically serve as a medium of exchange or a store of value, crypto tokens can represent a multitude of functions, including governance, access rights to a service, or even a stake in a decentralized application (DApp). This distinction is crucial for understanding the diverse applications and implications of tokens in the digital economy.

The creation of crypto tokens generally involves smart contracts, which are self-executing contracts with the terms directly written into code. These smart contracts automate the exchange of the tokens, ensuring that their operations happen without intermediary oversight. This eliminates the need for trusted intermediaries, enhancing security and efficiency within transactions. The nature of tokens allows them not only to be traded on various platforms but also to serve specific purposes within their respective networks. For instance, utility tokens grant holders access to a service or product, while security tokens represent ownership in an asset, such as shares in a company.

Despite their various forms and purposes, all crypto tokens share a common underlying technology: the blockchain. This decentralized ledger system underpins the operation of tokens, maintaining transparency, security, and traceability of transactions. As the blockchain technology evolves, so does the functionality and significance of crypto tokens, pushing the boundaries of conventional financial transactions and asset management. Understanding these foundational elements is essential for those looking to explore the various types of tokens available in the market. Emphasizing their distinct roles and capabilities sets the stage for a deeper examination of the specific categories of crypto tokens and their practical applications.

Table of Contents

Types of Crypto Tokens

Crypto tokens can be categorized into several distinct types, each serving unique purposes and functionalities within the blockchain ecosystem. Understanding these categories is essential for anyone seeking to navigate the cryptocurrency landscape effectively.

One of the most common types are utility tokens. These tokens are designed to provide users with access to specific products or services within a given platform. They are often associated with initial coin offerings (ICOs) and can be utilized exclusively within their respective blockchain ecosystem. An example of a utility token is Binance Coin (BNB), which users can use to pay for transaction fees on the Binance exchange.

Another important category is security tokens, which represent ownership of a real-world asset and are subject to regulatory requirements. Security tokens often reflect an investment in a company or project, making them more akin to traditional securities. This type of crypto token provides investors with rights similar to those of stockholders, such as profit sharing or dividend payments. A leading example is tZero, which focuses on blockchain technology to facilitate the trading of security tokens.

Equity tokens are closely related to security tokens but specifically signify an ownership stake in a company or organization. These tokens grant holders a right to company profits and voting rights, akin to share ownership in the corporate world. Platforms like 20|30 are examples of equity token offerings, built to democratize investment opportunities.

Lastly, there are asset-backed tokens, which are pegged to real-world assets such as gold or real estate. These tokens aim to provide stability by backing their value with tangible assets. An example includes Tether Gold (XAUT), a digital asset that represents physical gold holdings and allows investors to hold and transfer the value of gold without the complexities of owning physical bullion.

Utility Tokens: Function and Purpose

Utility tokens represent a significant category of crypto tokens designed primarily to provide users with access to a product or service within a specific ecosystem. Unlike cryptocurrencies like Bitcoin or Ethereum, which serve primarily as a store of value or a medium of exchange, utility tokens are intrinsically linked to a particular platform or protocol, enabling holders to perform actions or utilize features that the platform offers. This connection defines the fundamental utility of these tokens.

One of the principal purposes of utility tokens is to facilitate the use of decentralized applications (dApps). For instance, in platforms such as Ethereum, tokens like Basic Attention Token (BAT) allow users to access services related to digital advertising and compensation models that prioritize user engagement. Similarly, the Golem Network’s GNT tokens enable users to harness decentralized computing power, demonstrating the multifaceted roles that utility tokens can play.

Moreover, utility tokens often function as a means of fundraising for new projects. Through initial coin offerings (ICOs) or token sales, developers can issue tokens that grant early supporters the ability to engage with their services prior to full platform launch, further incentivizing users to participate in the ecosystem. This unique aspect of utility tokens underscores their relevance in the growing landscape of digital finance and technology.

The implications of utilizing utility tokens in dApps extend beyond simple transactions. Users can gain access to exclusive features, discounts, or premium services within the platform, thereby enhancing their overall experience. Additionally, the adoption of utility tokens can promote community engagement and foster a more collaborative environment as stakeholders in the platform incentivize each other’s participation.

As the cryptocurrency market continues to evolve, understanding the distinct roles of various types of crypto tokens becomes increasingly vital. Utility tokens, in particular, showcase how these digital assets can fundamentally enhance functionalities within decentralized frameworks, ultimately shaping the future of online services.

Security Tokens: Regulation and Compliance

Security tokens represent a significant advancement in the tokenization of assets, providing a compliant bridge between traditional financial instruments and the burgeoning world of digital currencies. Unlike utility tokens, which grant holders access to specific applications or services, security tokens are backed by real-world assets such as shares in a company, real estate, or bonds. This characteristic qualifies them as securities, meaning they are subject to stringent regulations and compliance with securities laws.

The regulatory framework for security tokens varies by jurisdiction but often requires that they adhere to existing securities legislation. In the United States, for instance, security tokens must generally comply with the Securities and Exchange Commission (SEC) regulations. This may involve registering the offering unless it qualifies for an exemption, ensuring full transparency, and conducting proper disclosures to protect investors. The emphasis on regulation serves to instill trust and confidence among potential investors, as it requires companies to undergo rigorous scrutiny, thereby minimizing fraud and market manipulation.

One of the standout benefits of security tokens is their facilitation of fractional ownership. Through tokenization, expensive assets can be divided into smaller, more affordable shares, thus allowing a broader range of investors to participate in previously inaccessible markets. For example, a real estate property that might traditionally require substantial capital can now be fractionated into smaller units, allowing multiple investors to own a portion of the asset. This democratization of investment opens up new possibilities for diversification and risk management.

Moreover, security tokens often come with enhanced investor rights, including dividends, profit-sharing, or voting rights, depending on how the tokens are structured. These rights can create a more equitable investment landscape, bolstering investor confidence and engagement. Overall, the compliance and regulatory alignment of security tokens not only protects investors but also reinforces the infrastructure of the cryptocurrency ecosystem.

Asset-Backed Tokens: Real-World Asset Integration

Asset-backed tokens represent a unique intersection between the digital realm of cryptocurrencies and tangible real-world assets. These tokens are essentially digital representations of actual physical assets, which can include real estate, commodities like gold and oil, or even fine art. By utilizing blockchain technology, these assets can be tokenized, allowing for greater accessibility and liquidity in markets that have traditionally been illiquid.

One of the primary advantages of asset-backed tokens is the enhanced liquidity they provide. In traditional settings, trading physical assets often involves cumbersome processes and lengthy timeframes. However, through tokenization, parties can buy, sell, or trade these digital tokens in real-time on various cryptocurrency exchanges. This instant accessibility not only lowers barriers for investors but also democratizes access to investment opportunities that might have previously been limited to high-net-worth individuals or institutional investors.

Transparency is another notable benefit of asset-backed tokens. Each transaction involving these tokens is recorded on a blockchain, creating a permanent, immutable ledger. This transparency assures investors about the authenticity and value of the underlying assets, which is crucial in mitigating risks and enhancing trust. Moreover, holders of asset-backed tokens often benefit from dividends or profit-sharing based on the performance of the tangible assets. This unique structure aligns the interests of token holders with the success of the underlying investments.

Several successful projects have embraced asset-backed tokens, showcasing the model’s potential. For instance, platforms like RealT enable investors to purchase fractional ownership of real estate properties through tokenized representations. Similarly, companies like Myco offer tokenized commodities, providing a straightforward method for individuals to invest in physical goods. Such projects exemplify the promising future of asset-backed tokens as they integrate real-world assets with blockchain technology, creating innovative investment opportunities.

Equity Tokens: Ownership and Rights

Equity tokens are a relatively novel application within the realm of blockchain technology, serving as a digital representation of ownership in a company or project. These tokens offer a unique approach to codifying equity, allowing investors to hold fractional shares in a firm through a tokenized format. This innovative form of investment harmonizes traditional equity structures with the advantages of blockchain, facilitating greater liquidity and accessibility.

The essence of equity tokens lies in their ability to provide investors with specific rights and benefits typically associated with conventional equity ownership. When an individual acquires equity tokens, they may gain voting rights, dividend payments, or even a share in the company’s profits, depending on the stipulations outlined during the token’s issuance. This potential for participation empowers investors, fostering a more engaged and informed shareholder base. Furthermore, the transparent nature of blockchain technology ensures that the rights associated with these tokens are verifiable and easily managed.

One of the prominent benefits of equity tokens is their role in democratizing investment opportunities. Through tokenization, individuals who may not have previously had access to equity in private companies or startups can invest their capital in a more accessible manner. This process broadens the investor pool, allowing for a diverse range of participants in what was traditionally a more exclusive market. Moreover, equity tokens facilitate smoother transactions and lower costs by eliminating intermediary roles often required in conventional equity trading.

By harnessing the potential of crypto tokens, the landscape of investment is transforming. As more companies look to venture into this space, equity tokens may reshape how ownership and rights are perceived, leading to a more inclusive financial ecosystem. As the appetite for innovative investment vehicles grows, equity tokens represent an exciting step towards integrating technology with traditional investment paradigms.

Governance Tokens: Voting and Control

Governance tokens have emerged as a pivotal component in the blockchain ecosystem, providing a mechanism for community-driven governance within decentralized projects. These tokens are a special class of crypto tokens that grant holders voting rights to influence decisions, rules, and changes within a blockchain protocol. By utilizing governance tokens, projects facilitate participation from their stakeholders, ensuring that decisions reflect the collective interests of the community.

The core functionality of governance tokens lies in their ability to enable decentralized decision-making processes. When holders possess these tokens, they can propose changes, vote on critical issues such as protocol upgrades, funding allocations, and overall project direction. This democratic approach fosters transparency and accountability, contrasting with traditional centralized models where a single entity makes crucial decisions. In decentralized autonomous organizations (DAOs), governance tokens are especially vital; they empower members to collaboratively steer the project’s development and operations.

Common use cases for governance tokens include voting on changes to consensus mechanisms, selecting development teams, and setting up treasury management protocols. For instance, holders of these tokens may decide how to allocate funds from a community treasury, prioritizing projects or initiatives that align with the community’s vision. Additionally, governance tokens play an essential role in incentivizing participation, as holders are often rewarded for their engagement in governance processes, rewarding those who contribute constructive input.

In the rapidly evolving landscape of blockchain technology, governance tokens serve as a crucial bridge between users and the underlying project infrastructure. As the space matures, the influence of these tokens is expected to grow, further embedding democratic principles in the governance structure of blockchain networks. By empowering users to have a say in decision-making, governance tokens are an essential tool for enhancing community engagement and ensuring that the development of crypto projects aligns with user interests.

Non-Fungible Tokens (NFTs): Unique Digital Assets

Non-fungible tokens (NFTs) have emerged as a revolutionary form of digital asset, representing unique items in the virtual world. Unlike traditional crypto tokens that are interchangeable and hold the same value, NFTs are distinct and cannot be replaced with something else. This uniqueness stems from the underlying blockchain technology that powers these tokens, primarily based on the Ethereum network, although other blockchains have also adopted NFT standards. NFTs are created through smart contracts which establish ownership and provenance of the digital asset.

The hallmark of NFTs is their ability to confer verifiable scarcity. Each NFT is encoded with specific information that delineates its uniqueness, making it possible to distinguish one token from another. This characteristic has made NFTs highly sought after, particularly in domains such as art, music, and digital collectibles. Artists and creators can now tokenize their work, allowing them to sell their pieces directly to collectors, devoid of traditional intermediaries. This shift not only empowers creators but also gives collectors a chance to own exclusive digital items.

The impact of NFTs on digital ownership is profound, providing a new layer of authenticity and value in the creative industries. Artists can gain royalties on secondary sales through smart contract functionalities. This innovation has resulted in significant financial opportunities for those who were previously limited in their ability to profit from their work. Moreover, NFTs have expanded the concept of ownership in the digital realm, offering individuals a stake in digital culture and experiences.

In conclusion, non-fungible tokens represent a significant evolution in the landscape of digital assets, bringing unique value and ownership to creators and collectors alike. As the technology continues to evolve, the implications of NFTs promise to reshape various industries, solidifying their place as a formidable element of the crypto ecosystem.

Stay informed, read the latest crypto news in real time!

Conclusion: The Future of Crypto Tokens

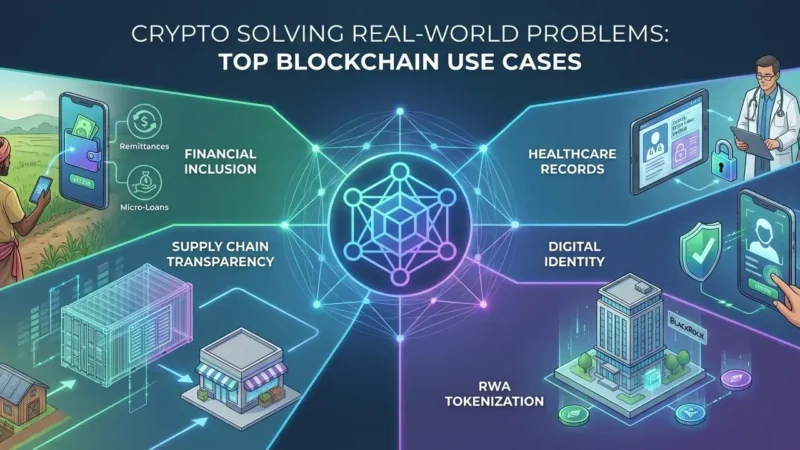

As the cryptocurrency landscape continues to develop rapidly, the understanding of different types of crypto tokens becomes increasingly important for both investors and developers. Each category of crypto token—such as utility tokens, security tokens, and stablecoins—serves a unique purpose and addresses specific market needs. Recognizing these distinctions facilitates informed decision-making, ultimately contributing to a more robust and efficient ecosystem. The applications of crypto tokens extend far beyond mere investment opportunities; they are integral in shaping industries like finance, real estate, and supply chain management.

Looking ahead, the potential for the tokenization of various assets stands poised to redefine ownership and trading structures. The ongoing advancements in blockchain technology hint at a future where not just cryptocurrencies, but a wide array of tangible and intangible assets, could be represented as tokens. This evolution necessitates a regulatory framework that can balance innovation with consumer protection, which in turn will drive greater institutional adoption. As regulators worldwide grapple with how to approach the diverse array of crypto tokens, we may see significant developments in policies that will shape the industry as a whole.

Moreover, the scalability and security of blockchain networks will be paramount in determining the future of crypto tokens. Enhancements in these areas could pave the way for more widespread utilization of blockchain beyond financial sectors, impacting healthcare, voting systems, and more. As developers of crypto tokens experiment with new use cases and functionalities, the landscape will continue to evolve, presenting both challenges and opportunities. Ultimately, staying informed about these changes not only aids individuals in navigating the market but also fosters a healthier ecosystem that benefits all stakeholders involved.