Crypto Regulations Around the World: A Comprehensive Country-by-Country Guide

TL;DR: Key Takeaways

- The Global Patchwork: There is no single international standard; rules range from total bans to making Bitcoin legal tender.

- The EU Leads the Way: The Markets in Crypto-Assets (MiCA) regulation provides the first comprehensive legal framework for a major economic bloc.

- The US Stance: Focuses heavily on enforcement via the SEC and CFTC, leading to calls for clearer legislative guidance.

- Asia’s Duality: While China maintains a strict ban, hubs like Hong Kong, Japan, and Singapore are creating structured licensing regimes.

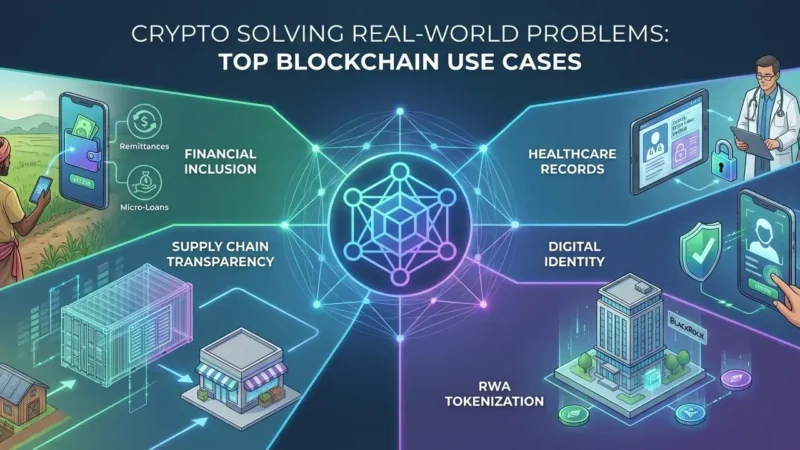

- Emerging Markets: Countries in Latin America and Africa are increasingly integrating digital assets for financial inclusion and remittances.

The digital asset landscape has moved far beyond its “Wild West” origins. Today, the question for investors and developers is no longer just about market volatility, but about compliance. Understanding the evolving state of crypto regulation is essential for anyone navigating the blockchain space.

As governments attempt to balance innovation with consumer protection and financial stability, a complex patchwork of cryptocurrency laws has emerged. In this guide, we break down how different regions are approaching the sector and answer the fundamental question: is crypto legal in your jurisdiction?

The Importance of Regulatory Frameworks

Without clear rules, the industry faces “regulatory uncertainty,” which can stifle institutional adoption. Effective oversight aims to prevent money laundering (AML), ensure “know your customer” (KYC) compliance, and protect retail investors from fraud. However, the approach varies significantly from one border to the next.

North America: A Focus on Enforcement

The United States

In the U.S., the legal status of digital assets remains a subject of intense debate. Rather than a single set of rules, the country operates through various agencies. The Securities and Exchange Commission (SEC) often views many altcoins as securities, while the Commodity Futures Trading Commission (CFTC) views Bitcoin as a commodity.

The current atmosphere is often described as “regulation by enforcement.” While there is no federal ban, the lack of a bespoke legislative framework has led to high-profile lawsuits against major exchanges. For many, the future of American crypto regulation hinges on upcoming bills in Congress aimed at defining stablecoins and exchange operations.

Canada

Canada was one of the first nations to bring crypto platforms under anti-money laundering laws. It requires all “money service businesses” to register with FINTRAC. Canada also became a pioneer by approving the world’s first Bitcoin ETFs, signaling a more structured, though strict, path for institutional growth.

Europe: Setting the Gold Standard

The European Union and MiCA

The European Union has taken a massive leap forward with the Markets in Crypto-Assets (MiCA) regulation. This is the first major jurisdiction in the world to introduce a comprehensive, harmonized set of rules for the 27 member states.

MiCA provides clear guidelines for issuers of digital assets and service providers. It covers everything from transparency and disclosure to the supervision of stablecoins. By creating a “passportable” license that allows firms to operate across the entire EU, this landmark crypto regulation is expected to attract significant investment to the continent.

The United Kingdom

Post-Brexit, the UK is striving to become a global crypto hub. The government is progressively bringing digital assets under the scope of existing financial services regulations. The focus here is on “same risk, same regulatory outcome,” ensuring that crypto activities are held to the same high standards as traditional banking.

Asia-Pacific: A Study in Contrasts

China

China remains the most prominent example of a “prohibitionist” stance. In 2021, the government intensified its crackdown, effectively banning all crypto trading and mining within its borders. However, China is simultaneously a leader in Central Bank Digital Currencies (CBDCs), having extensively trialed the digital yuan (e-CNY).

Hong Kong, Japan, and Singapore

In contrast to the mainland, Hong Kong has recently opened its doors, inviting retail investors back through a strict licensing regime for exchanges. Japan was one of the first to recognize Bitcoin as legal property and has a highly developed legal structure. Singapore, while cautious about retail speculation, remains a top destination for Web3 startups due to its clear, albeit rigorous, licensing under the Payment Services Act. This diverse approach to crypto regulation across Asia makes it one of the most dynamic regions to watch.

Latin America: The Land of Adoption

El Salvador

El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender. Under this law, businesses must accept Bitcoin for payments if they have the technological means. This move was designed to boost financial inclusion and lower remittance costs, though it has faced scrutiny from international bodies like the IMF.

Brazil and Argentina

Brazil has introduced a comprehensive legal framework that recognizes “virtual assets” and puts them under the oversight of the Central Bank. Argentina, facing high inflation, has seen massive organic adoption. While the government has historically been wary, the recent political shifts suggest a move toward more innovative crypto regulation to stabilize the economy.

Middle East and Africa: Emerging Hubs

United Arab Emirates (UAE)

The UAE, and specifically Dubai, has positioned itself as a global leader. The establishment of the Virtual Assets Regulatory Authority (VARA) provides a dedicated legal framework for the industry. Dubai’s “crypto-friendly” reputation is a result of having a transparent, tech-forward hub for crypto regulation that invites international firms to relocate.

Nigeria and South Africa

Nigeria has one of the highest rates of crypto usage in the world. Despite previous friction between the central bank and the industry, the country is moving toward a framework that recognizes digital assets as securities to better track transactions. South Africa has also begun requiring crypto exchanges to apply for licenses, treating digital assets as financial products.

Is Crypto Legal? A Quick Reference

The legality of cryptocurrency generally falls into four categories:

- Legal Tender: Bitcoin is officially recognized as currency (e.g., El Salvador).

- Regulated/Legal: Crypto is legal to own and trade, subject to AML/KYC and tax laws (e.g., USA, EU, Brazil).

- Restricted: Banking bans or limitations on trading (e.g., India, Nigeria).

- Banned: Absolute prohibition on ownership and trading (e.g., China, Morocco).

The Future of Global Compliance

As the industry matures, we are seeing a shift toward “Global North” standards. The Financial Action Task Force (FATF) continues to push the “Travel Rule,” requiring service providers to share transaction data. Navigating crypto regulation will require companies to be agile, as rules in 2024 and 2025 are likely to become more stringent regarding decentralized finance (DeFi) and privacy coins.

Stay informed, read the latest crypto news in real time!

Conclusion

The global legal landscape is no longer a monolith of uncertainty. While some nations remain hesitant, the trend is clearly toward structured oversight rather than outright bans. From the comprehensive MiCA rules in Europe to the burgeoning hubs in the Middle East, the future of crypto regulation is about creating a safe, transparent environment where digital finance can thrive alongside traditional systems.

For investors, the message is clear: staying informed on cryptocurrency laws is the best way to protect your assets and stay ahead of the curve in this rapidly changing market.