Breaking Decentralized Finance News: The Latest Updates on DeFi Trends and Innovations

Decentralized Finance (DeFi) has become one of the most transformative movements in the financial sector, redefining traditional financial systems by leveraging blockchain technology. In this article, we’ll explore the latest developments, insights, and trends in decentralized finance news.

Table of Contents

What Is Decentralized Finance?

Decentralized Finance, or DeFi, is a blockchain-based financial ecosystem that eliminates the need for intermediaries such as banks or financial institutions. By using smart contracts, DeFi platforms enable users to trade, lend, borrow, and earn interest on their digital assets directly.

Key features include:

- Permissionless Transactions: No need for a centralized authority to approve financial activities.

- Transparency: Every transaction is recorded on the blockchain, ensuring accountability.

- Global Access: Accessible to anyone with an internet connection and a digital wallet.

Why Is Decentralized Finance Making Headlines?

The rapid evolution of DeFi has disrupted traditional finance by introducing innovative ways to manage assets. Here are the current reasons why decentralized finance news continues to dominate headlines:

- DeFi Adoption: Mainstream institutions are integrating DeFi solutions to modernize their operations.

- Regulatory Discussions: Governments worldwide are debating how to regulate this emerging sector.

- Technological Innovations: Protocols like Ethereum 2.0 are enhancing the scalability of DeFi platforms.

Key Trends in Decentralized Finance News

1. DeFi Protocol Upgrades

As scalability remains a challenge, protocols are upgrading to improve performance. Ethereum’s shift to Proof-of-Stake (PoS) with Ethereum 2.0 has paved the way for cheaper and faster transactions.

2. Cross-Chain Solutions

Cross-chain technology is growing, enabling seamless interaction between different blockchain ecosystems. Projects like Polkadot and Cosmos are leading this revolution.

3. NFT Integration with DeFi

Non-fungible tokens (NFTs) are being incorporated into DeFi platforms. Users can now collateralize NFTs to access loans or earn yield.

4. Regulatory Updates

Global governments are increasingly addressing regulatory frameworks for DeFi. While some regulations promote transparency, others pose challenges for decentralized protocols.

The Rise of Decentralized Exchanges (DEXs)

Decentralized exchanges have grown exponentially due to their user autonomy and transparency. Unlike centralized exchanges, DEXs such as Uniswap and PancakeSwap allow users to trade directly from their wallets.

Advantages of DEXs:

- No need for KYC (Know Your Customer).

- Lower risk of hacks due to self-custody.

- Access to a broader range of tokens.

Major Players in the DeFi Space

1. Aave

Aave has revolutionized DeFi lending with features like flash loans and multi-collateral borrowing.

2. MakerDAO

Known for creating DAI, a stablecoin pegged to the US dollar, MakerDAO is a pioneer in the DeFi lending sector.

3. Curve Finance

Specializing in stablecoin trading, Curve Finance offers low-slippage transactions for stable assets.

Challenges in Decentralized Finance

Despite its promising future, the DeFi ecosystem faces several hurdles:

- Security Risks: Smart contract vulnerabilities can lead to significant losses.

- Regulatory Uncertainty: Ambiguity in regulations may deter institutional investment.

- Scalability Issues: High transaction fees and slow confirmation times hinder mass adoption.

How to Stay Updated on Decentralized Finance News

Keeping up with decentralized finance news is essential for anyone involved in the crypto and blockchain industry. Reliable sources include:

- Industry Blogs and News Portals: Websites like Decrypt, CoinDesk, and CryptoSlate provide regular updates.

- Social Media Platforms: Follow influencers and DeFi projects on Twitter and Reddit.

- Community Forums: Engage with DeFi communities on Discord or Telegram.

The Role of Decentralized Finance in Web3

Web3 envisions a decentralized internet, and DeFi plays a pivotal role by enabling financial freedom. With the integration of DeFi into Web3 applications, users can seamlessly access financial services in a decentralized environment.

Future Prospects for Decentralized Finance

1. Mass Adoption of Stablecoins

Stablecoins are becoming the backbone of DeFi due to their price stability and global acceptance.

2. Institutional Interest in DeFi

Institutions are exploring DeFi for improved efficiency and reduced costs. Partnerships between traditional financial players and DeFi platforms are on the rise.

3. AI Integration in DeFi

Artificial Intelligence is enhancing DeFi protocols by improving risk management, detecting fraud, and optimizing yield strategies.

How to Get Started with DeFi

If you’re new to DeFi, follow these steps to get started:

- Set Up a Wallet: Choose a DeFi-compatible wallet like MetaMask or Trust Wallet.

- Fund Your Wallet: Purchase cryptocurrency such as ETH or stablecoins.

- Choose a Platform: Explore platforms like Aave, Compound, or Uniswap.

- Start Small: Begin with minimal investments to understand the ecosystem.

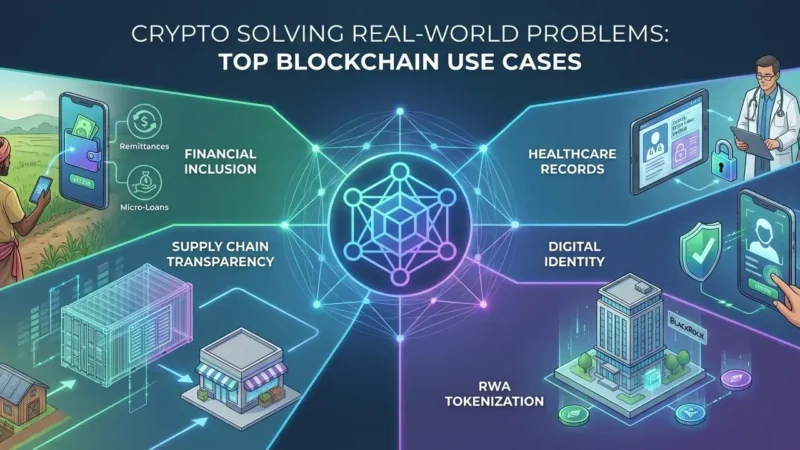

Impact of Decentralized Finance on the Global Economy

Decentralized finance is reshaping global financial systems by offering alternatives to traditional banking. This impact is particularly notable in:

- Developing Nations: DeFi provides banking access to the unbanked population.

- Wealth Redistribution: Democratized access to financial tools reduces wealth inequality.

Frequently Asked Questions (FAQs)

1. What is decentralized finance?

Decentralized Finance (DeFi) is a blockchain-based financial system that eliminates intermediaries in financial transactions.

2. How can I stay informed about decentralized finance news?

Follow industry blogs, social media channels, and DeFi-focused forums for real-time updates.

3. What are the risks of using DeFi platforms?

Risks include smart contract vulnerabilities, regulatory changes, and market volatility.

4. Which blockchain is most commonly used in DeFi?

Ethereum is the most widely used blockchain, though others like Binance Smart Chain and Solana are also gaining traction.

5. How do I earn passive income with DeFi?

You can earn passive income through staking, yield farming, or lending your assets on DeFi platforms.

6. Are decentralized exchanges safe?

While decentralized exchanges are generally secure, users must take precautions such as using secure wallets and avoiding phishing sites.

Stay informed, read the latest crypto news in real time!

Conclusion

Decentralized Finance is transforming the way we perceive and interact with financial systems. By staying updated on decentralized finance news, you can take advantage of this rapidly evolving space. From innovative protocols to challenges and future prospects, the world of DeFi holds immense potential for innovation and financial empowerment.

2 thoughts on “Breaking Decentralized Finance News: The Latest Updates on DeFi Trends and Innovations”